Brexit, TPR and CySEC CIF Application & Authorisation

Mid-December 2020, the Cyprus Securities and Exchange Commission (CySEC) announced the establishment of a Temporary Permissions Regime (TPR) which applies to UK Investment Firms authorized and regulated by the FCA. The aim of establishing the TPR is to facilitate a smooth transition for UK firms for them to make the necessary arrangements and either apply to CySEC for a Cyprus Investment Firm (CIF) or a Cyprus branch.

On the 27th of April 2021, CySEC officially revealed the established Temporary Permission Register, in which 88 UK Investment Firms granted a Temporary Permission to provide investment services to per se professional clients and eligible counterparties in Cyprus on a cross-border basis until 31 December 2021.

From January 1st, 2022, onwards, the TPR will be withdrawn. These 88 UK investment firms – and all other investment firms from the UK – will be required to establish a Cyprus branch or apply for a Cyprus Investment Firm (CIF) license should they wish to provide investment services to the European Union member states through passporting.

Within this commentary, SALVUS Team provides more details on the application process of a Cyprus Investment Firm (CIF),

The application process of a Cyprus Investment Firm (CIF)

A. Incorporating a Cyprus Company

The Cyprus Company to be incorporated needs, a specific and appropriate to its scope, Memorandum and Articles document. The shareholders, the directors and the secretary of the company are needed at this stage of the process. The procedure:

- application for approval of the Company’s name to the Registrar of Companies,

- the registration of the Company,

- receipt of the Incorporation documents of the Company;

- Certificate of Incorporation,

- Certificate of Shareholders,

- Certificate of Directors and Secretary,

- Certificate of Registered Office,

- Memorandum and Articles of Association.

B. Organization Structure

Start with the Board of Directors

Finding the CIF’s Board of Directors (BoD), if it is not chosen yet, it is the first step towards applying to CySEC. Irrespective of the investment and ancillary services, the minimum requirement is for:

- Two Executive Directors – they also satisfy the four-eyes principle and are employed on a full-time basis,

- Two independent Non-Executive Directors (NEDs),

- A Non-Executive Director (NED) who is a shareholder.

The minimum number of Directors is four persons. Worth noting that the applicant CIF must have the majority of the BoD residing in Cyprus. Many times, CySEC will request the shareholders to be also members of the BoD, either as executive directors or non-executive directors.

* The executive directors are expected to be employed on a full-time basis once they are approved by CySEC and at the pre-approval stage.

One member of the Board must be also designated as the Anti-Money Laundering (AML) Director. It will be an add-on for this person to hold the AML CySEC Examination.

Beyond the board, the following functions are required to be in place within three months after the pre-license approval is granted:

- Compliance Officer and Anti-Money Laundering (AML) Compliance Officer: This employee must be working out of Cyprus and work on a full-time and exclusive basis. The two roles can be undertaken by one person, proportionally to the risk, scale, and nature of the firm. This person must hold the CySEC AML Examination and CySEC Advanced Examination.

- Head of Brokerage Department: If the relevant investment service of Reception and Transmission of Orders is to be offered and performed, this position must be filled by a person residing in Cyprus based. This person must hold either the CySEC Basic Examination or the CySEC Advanced Examination.

- Head of Dealing on Own Account: This employee is required if the Company is applying for the investment service of Dealing on Own Account. The employee must be working out of Cyprus and to be working on a full-time and exclusive basis for the Company. This person must hold the CySEC Advanced Examination.

- Risk Manager: There are possible options for this position:

- Hire a full-time employee to undertake these duties,

- Outsource this function to the SALVUS specialist team, along with the preparation of all Risk Reporting Obligations of the Firm.

- Head of Accounting Department (safekeeping and Back office): this function can be outsourced or hire two people to perform those duties.

- Head of Information Technology (IT): A full-time employee has to be hired for this role, while significant duties of this department can be outsourced to an external service provider.

- Internal Auditor: This function must be outsourced.

- External Auditor: This function must be outsourced.

C. Preparation and submission of the CIF Application

The CIF Application Form provides information about

- the Company which will become authorized to offer and perform investment and ancillary services as an Investment Firm,

- the shareholders and the directors of the Company.

The application form needs to be completed and be accompanied by the following

- Incorporation documents of the Company (mentioned above)

- Source of funds details – It is required to present evidence that the required capital exists for the share capital plus funds to support the operation of the Company for at least 3 years. Further, it is required to justify the source of these funds.

- Organization chart of the Company (and of the group, if applicable),

- Completed questionnaires in relation to the Directors, and the shareholders (legal and/or natural persons).

- Personal information and documents of the directors and the shareholders. In particular:

- Signed and completed Personal Questionnaire. This questionnaire requires information on past professional experience, contact details, holdings in any legal entities, academic and other qualifications, and names and details of two persons who can provide references.

- Updated/recent CV

- Notarized/Apostilled copy of passport.

- Original Certificate of Non-Bankruptcy from the competent authorities of the country in which he has resided for the last five years (officially translated in English).

- Original Certificate of Clean Criminal Records from the competent authorities of the country in which he has resided for the last five years (officially translated in English).

* If the direct shareholder is a legal entity, then corporate documents and audited financial statements will need to be provided,

- Policies, procedures, and appointments of the applicant CIF, including;

- Business plan,

- Anti-Money Laundering and terrorist financing Manual,

- Internal Operations Manual,

- Best Execution Policy,

- Product Governance Policy,

- Annual consolidated financial accounts for the last three years (if applicable),

- Certification of the representative, external auditors, and legal advisors of the Applicant CIF.

D. Time frames to keep in mind till and after the application is submitted

- Incorporation of Cyprus Company, between five to ten working days,

- Preparation of the application, approximately one month from the day all documentation is provided,

- Pre-licensing approval by CySEC will take approximately three-four months for the fulfillment of the conditions. SALVUS team supports you with the provision of consulting and guidance on all regulatory requirements for ensuring the granting of the final Authorisation.

- Deposit the minimum capital required in a bank based in the European Economic Area and blocked until the CIF license is granted, three to four weeks after the pre-license approval is provided.

- After the fulfillment of the conditions of the pre-approval, the final license is normally granted within two to three weeks for the CIF Authorization by CySEC.

Overall, the CIF authorization by CySEC takes on average eight to ten months considering that no exceptional circumstances are surrounding the application. It is possible to utilize the fast-track scheme of CySEC based on which there is an additional fee of EUR 25.000 paid to CySEC which can reduce the processing time of the application by CySEC.

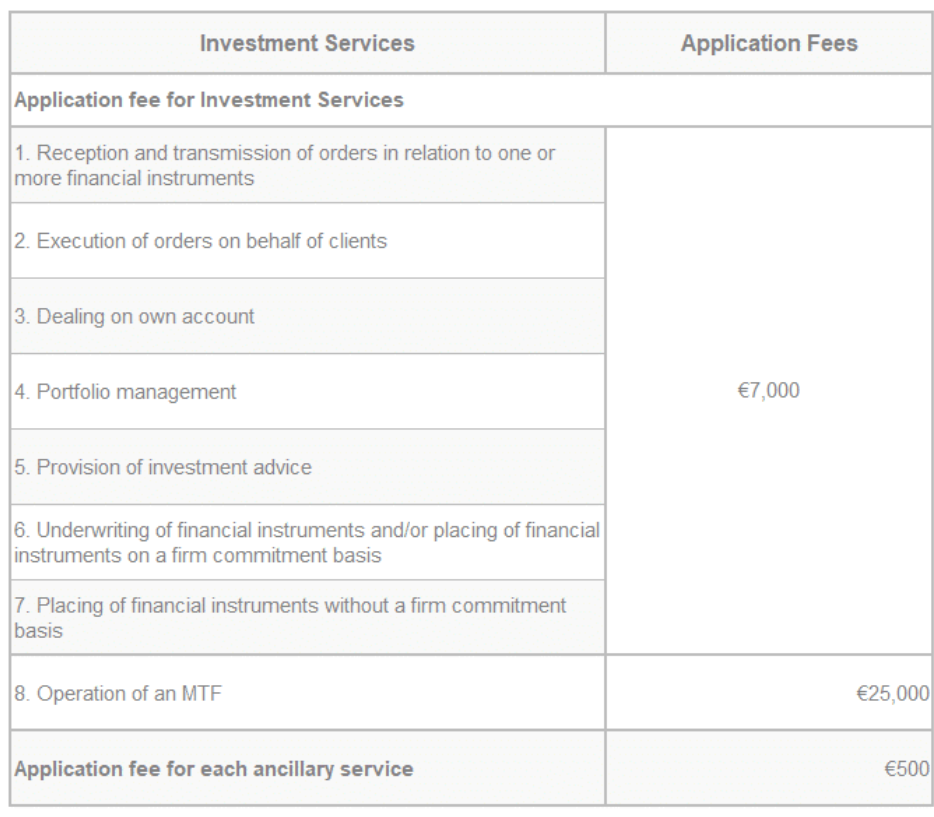

E. Application fees payable to CySEC

The applicable fees to be paid to CySEC along with the application for a CIF license for the respective investment and ancillary services, and the fees for other applications, as per the Directive DI87-03, are listed below.

Conclusion

All the above will be examined by CySEC, while we as SALVUS remain committed to adding value by

- diligently monitoring our clients’ and partners’ CIF applications and

- handling the application using insights from our experience,

throughout the application process, during its activation, and after its authorization. We warrant that all resources and relevant requirements, such as minimum capital, personnel, and corporate structure are optimized.

Our expertise, beyond the CySEC license application, serves objectives such as ongoing Compliance Officer support and agile Internal Audit performance among others.

The team at SALVUS is engaged and supports a number of reputable UK investment firms with a new application to get authorized as a CIF or on acquisition of an existing one. SALVUS and our chosen associates can provide the full range of services required to support Cyprus Investment Firms, before, during, and after the granting of the CIF authorization. As we deal in Licensing, Compliance, Risk Management, and Internal Audit, our services beyond the CIF License application, include Activation support, ongoing Compliance Officer support, and Internal Audit Services among others.

We remain at your disposal should you have any questions on the above. Please email us at info@savlusfunds.com.

#Stayahead

Should you be interested to read about relevant topics on the licensing procedure of a Cyprus Investment Firm (CIF), please visit the selected articles below:

- Cyprus, CySEC, MiFID Investment and Ancillary Services

- The Upgraded Legal Framework of the Investor Compensation Fund

- Q&A for the Cyprus Investor Compensation Fund (ICF)

The information provided in this article is for general information purposes only. You should always seek professional advice suitable to your needs.