Investment Firms New Capital Requirements (IFR & IFD)

Following a series of consultation papers and subsequent guidance by the European Banking Authority (EBA), the Cyprus National Competent Authority (NCA), CySEC, published – on Tuesday, 11th of May 2021 – the Law 98(I)/2021 on the capital adequacy of Investment Firms. The Law 98(I)/2021 transposes the European Investment Firms Regulation (EU) 2019/2033 (IFR) and Directive (EU) 2019/2034 (IFD). With these, the regulator sets the prudential requirements of Investment Firms, into national legislation.

The Capital Requirements Directive (CRD V) is part of a broad package of legislative amendments, which include the Capital Requirements Regulation II (CRR II) and aims to improve the risk and compliance management of investment firms. This reform is considered as the biggest banking regulatory reform, since the financial crash of 2008, and is applicable to all banks and investment firms within the European Union. For this, EBA has produced Regulatory Technical Standards (RTS) related to the implementation of a new prudential regime for investment firms on their prudential requirements under Regulation (EU) 2019/2033 (IFR) and Directive (EU) 2019/2034 (IFD).

The new regulatory framework will come into force on the 26th of June 2021, and ALL firms are required to understand the changes, ensure they are able to extract the necessary information and prepare the necessary Capital Adequacy Forms for submission to CySEC.

Within this article, the SALVUS Risk team provides more details of the new provisions of the law, providing guidance on

1. The New Initial Capital Requirements

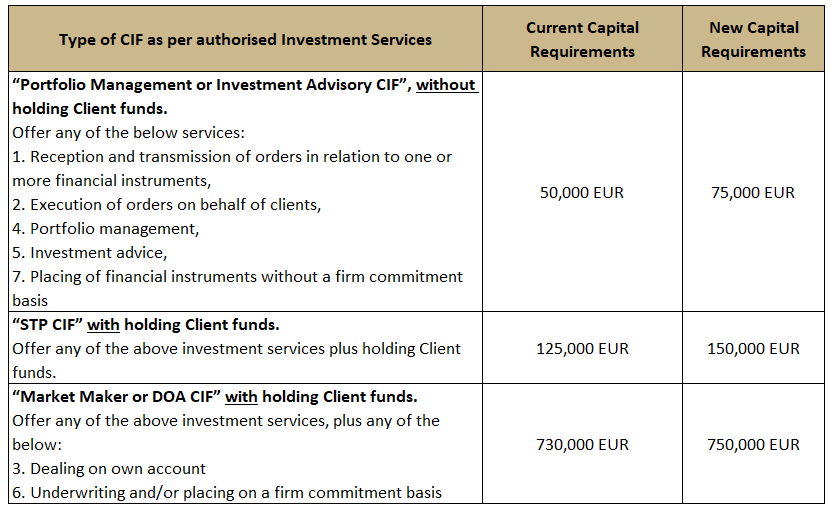

The IFR and IFD introduces new initial capital requirements for the authorisation of ALL Investment Firms according to the authorised investment services. The below table, lists the current minimum capital next to the new minimum capital requirements.

2. The Categorisation/Classification of Investment Firms

The IFR and IFD introduce a new classification system for investment firms, based on their activities, systemic importance, size and group connections. Thus, the requirements for the calculation of the CIF’s capital adequacy will be based on the class of the investment firm. The four categories are as follow:

Class 1A – This type of investment firm shall be considered a systemically important firm and will seek authorisation as a credit institution.

The firm is authorised to offer the investment service of

- Dealing on Own Account, and/or

- Underwriting of financial instruments and/or placing of financial instruments on a firm commitment basis,

is NOT

- a commodity and emission allowance dealer, or

- a collective investment undertaking, or

- an insurance undertaking,

AND meets ANY of the below conditions,

- the assets are equal to or exceed EUR 30 billion, or

- the assets of the undertaking are less than EUR 30 billion, and the undertaking is part of a group in which the consolidated assets of all undertakings in that group that individually have total assets of less than EUR 30 billion and that carry out any of the investment services mentioned above is equal to or exceeds EUR 30 billion,

- the assets of the undertaking is less than EUR 30 billion, and the undertaking is part of a group in which the consolidated assets of all undertakings in the group that carry out any of the investment services mentioned above is equal to or exceeds EUR 30 billion.

Class 1B – This type of investment firm shall remain as Investment Firm.

The firm is authorised to offer the investment service of

- Dealing on Own Account, and/or

- Underwriting of financial instruments and/or placing of financial instruments on a firm commitment basis,

is NOT

- a commodity and emission allowance dealer, or

- a collective investment undertaking, or

- an insurance undertaking,

AND meets ANY of the below conditions,

- the assets are equal to or exceed EUR 15 billion, or

- the assets of the investment firm is less than EUR 15 billion, and the investment firm is part of a group in which the total consolidated assets of all undertakings in the group that individually have total assets of less than EUR 15 billion and that carry out any of the investment services mentioned above is equal to or exceeds EUR 15 billion.

Class 2 – This type of investment firm does not fulfill the requirements of Class 1 or Class 3. Most of the firms that typical fall under this class is the so called

- “STP CIF” that hold Client funds, and

- “Market Maker CIF” that do not meet the criteria of class 1.

Class 3 – This type of investment firm is typically called as a “Portfolio Management or Investment Advisory CIF” without holding Client funds. This type of firm qualifies as small and non-interconnected investment firm, when fulfills ALL the below criteria;

- The firm does not

- safeguards or administer assets,

- hold Client money,

- have trading flow on its own books,

- have a market risk either on position risk or clearing guarantees,

- have a trading counterparty credit risk,

- The assets under management are less than EUR 1.2 billion,

- The Client orders handled are less EUR 100 million/day for cash trades or EUR 1 billion/day for derivatives,

- The on‐ and off‐balance‐sheet total of the investment firm is less than EUR 100 million,

- The total annual gross revenue from investment services and activities of the investment firm is less than EUR 30 million.

3. The transition from Credit Risk, Market Risk and Operational risk into the K-Factors requirements

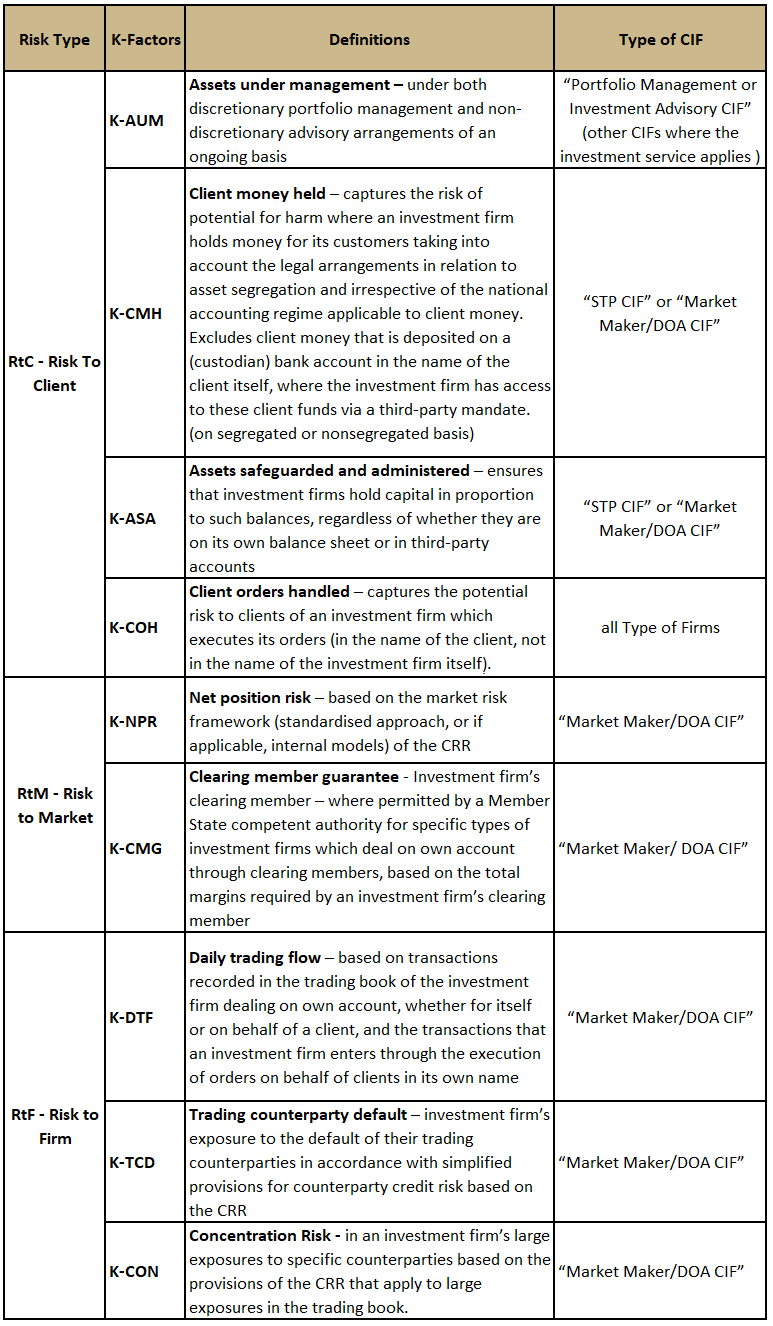

The IFR and IFD replaces the risk types Credit Risk, Market Risk and Operational risk into a new risk type category that aims to capture better the risks pose to customers, the market and the firm itself. The new risk type system and its sub-risks “K-Factors” are elaborated further.

The abbreviations used for each risk type are as follows:

- Risk to Client (‘RtC’),

- Risk to Market (‘RtM’),

- Risk to Firm (‘RtF’).

In the table below, the SALVUS Risk Team provides more details on the risk types, the K-Factors, and for which type of CIFs they are applicable.

4. The own funds requirements

The new regulatory framework introduces new calculations for the own funds requirements and the composition of own funds, as below:

A. Investment Firms shall have own funds equal or above to the HIGHEST of

- The Fixed overheads requirements = 0.25 of the preceding year’s fixed overheads,

- The Initial Capital Requirement as the above point 1,

- The sum of the K-Factors

- RtC (for “STP CIF”)

- RtC + RtM + RtF (for “Market Maker or DOA CIF”).

* It is worth noting that for class 3 the Sum of the K-Factors is not applicable.

B. The initial capital of an Investment Firm is consisted by the

- Common Equity Tier 1 capital (‘CET1’),

- Additional Tier 1 capital (‘AT1’),

- Tier 2 capital (‘T2’)

At ALL times, CIFs must meet the following conditions:

- CET1 / the highest of point B to be greater or equal to 56%

- (CET1 + AT1) / the highest of point B to be greater or equal to 75%

- (CET1 + AT1 + T2) / the highest of point B to be greater or equal to 100%

5. The Reporting Requirements and Deadlines

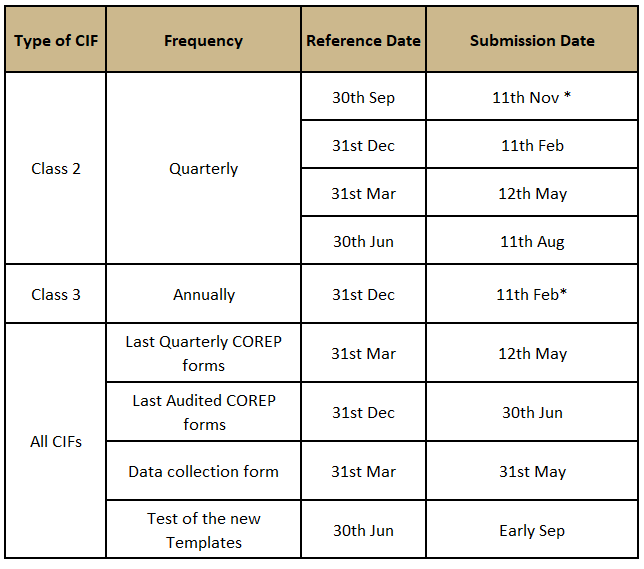

During the next few months CySEC will perform a data collection for the classification of CIFs and, the regulator will also proceed with testing phase of the new templates based on the CRR II and CRD V regulatory framework. Additionally, CySEC announced the timelines for submitting the capital adequacy forms based on the CRR and CRD IV regulatory framework.

The Risk team at SALVUS presents below the frequency of submissions, the reference dates and their submission deadlines.

* First Submissions Dates using the new templates.

Our Risk team at SALVUS is carrying its extensive experience in designing, implementing, and delivering regulatory reporting solutions. We are ready to support you in complying with the new regulatory framework, either to prepare the forms on your behalf or to provide consultation to your internal team. We remain at your disposal and should you have any questions, please contact us at info@salvusfunds.com.

#StayAhead.

The information provided in this article is for general information purposes only. You should always seek professional advice suitable to your needs.