ESG Regulations for European regulated entities

The environmental, social, and governance (ESG) framework examines consequences that may positively or negatively impact the financial performance or solvency of investments, natural or legal persons because of influences derived from environmental, social and governance matters. On a European level, the ESG framework aims for the transition to a more sustainable economy.

ESG risks such as climate change, global warming, inequality, labour relations, bribery and corruption already present a negative financial impact on European regulated entities. Transitioning to a more environmentally friendly and sustainable financial system will come with challenges due to the scale, breadth, and complexity of the ESG risks to be managed.

Within this commentary the SALVUS Regulatory Compliance and Risk Management teams introduce key aspects of the ESG framework and discuss regulatory updates and requirements on a European level, as follows:

1. What are ESG factors?

2. Regulatory framework

3. Who shall ensure compliance?

4. New regulatory requirements

5. Application timeframes

We regularly share bite-sized insights on LinkedIn such as those found in this article

1. What are the ESG factors?

Environmental, social and governance factors help measure the sustainability and societal impact of business activities that are financed by credit institutions, financial products manufacturers and financial advisers.

Establishing common definitions of ESG factors and understanding how they translate into financial risks for individual institutions and the financial system as a whole, constitutes a fundamental part of evaluating ESG risks.

Examples of ESG factors presented across European legislation are:

- Environmental:

- Energy consumption and efficiency

- Water usage, recycling, and management

- Waste production and management

- Raw materials consumption

- Social:

- Child labour

- Implementation of fundamental conventions related to labour

- Inclusiveness, inequality and discrimination

- Human rights and gender equality

- Investment in human capital and communities

- Governance:

- Corruption and bribery

- Transparency and disclosure

- Board structure and diversity

- Shareholder engagement and rights.

Thus, ESG risks should be understood as the financial risks posed by an institution’s exposure to counterparties and invested assets, that may potentially be affected by or contribute to the negative impacts of ESG factors.

2. Regulatory framework

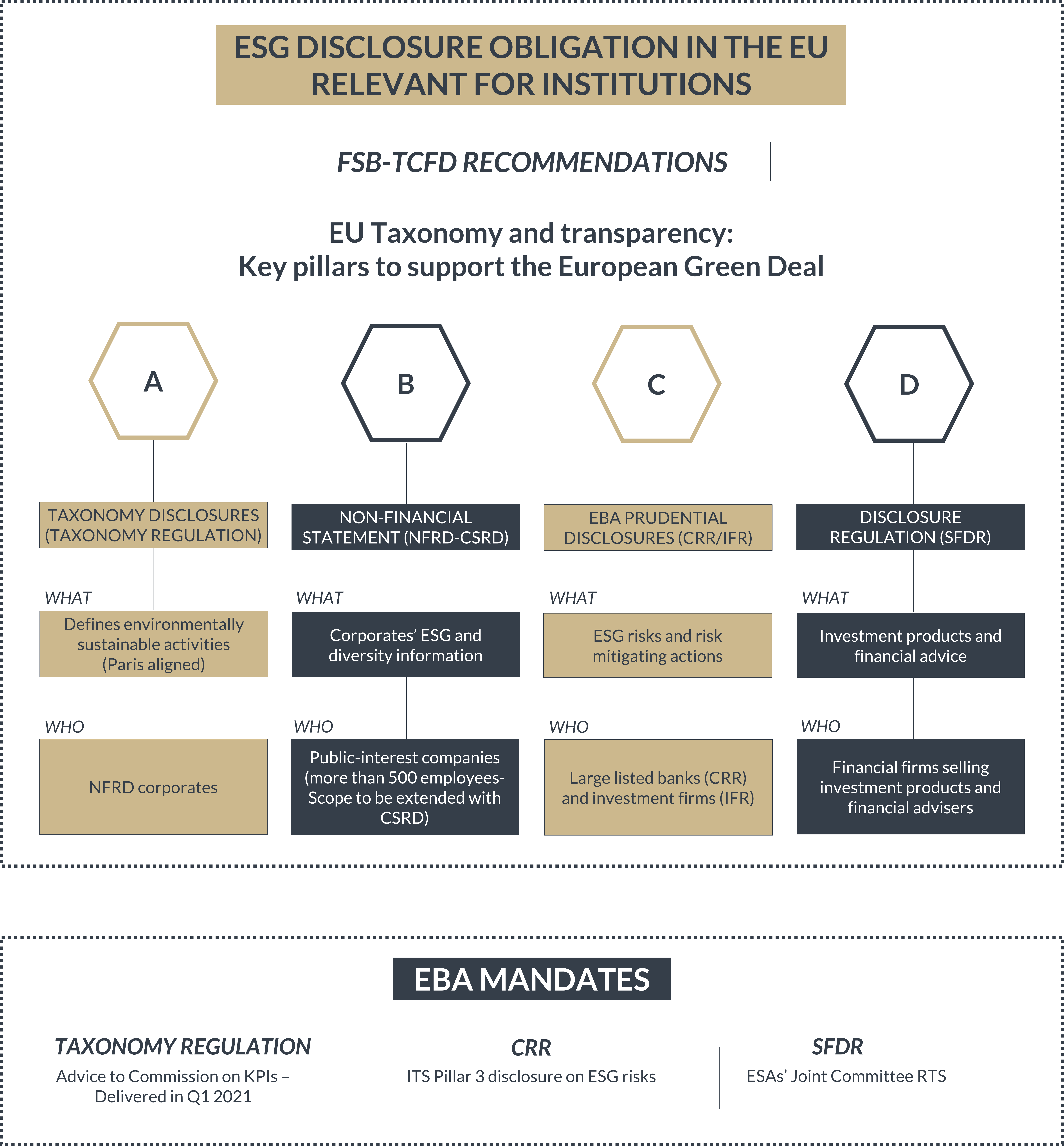

To support the European Green Deal, European authorities have introduced several legislative initiatives on ESG disclosures oriented on four key pillars, as per the diagram below.

Figure 1 – ESG disclosures in the EU: financial institutions – source: European Banking Authority (EBA)

NFRD: Non-Financial Reporting Directive

CRR: Capital Requirements Regulation

CSRD: Corporate Sustainability Reporting Directive

IFR: Investment Firms Regulation

SFDR: Sustainable Finance Disclosure Regulation

The two main pillars concerning financial institutions and investment firms are expressed by:

- The prudential disclosures of the European Banking Authority (EBA), based on provisions of the Capital Requirements Regulation (CRR) and the Investment Firms Regulation (IFR);

- Realised through EBA’s Implementing Technical Standards (ITS) for Pillar III disclosures on ESG risks and risk-mitigating actions.

- The Sustainable Finance Disclosure Regulation (SFDR);

- Complemented by the Regulatory Technical Standards (RTS), of European Supervisory Authorities (ESAs) regarding financial products and advice.

3. Who shall ensure compliance?

Compliance must be ensured by financial and investment institutions on different levels, based on different criteria. More specifically and according to:

- CRR, large institutions that have issued securities admitted to trading on a regulated market of any Member State shall disclose information on ESG risks through the ITS templates.

- IFR, investment firms categorised under class 2, are required to disclose prudential information on ESG risks similar to the information required from large institutions under the CRR.

- SFDR, financial market participants including Alternative Investment Funds Managers (AIFM) and financial advisers such as investment firms and credit institutions that provide portfolio management and investment advice, must make sustainability disclosures through ESAs’ RTS.

4. New regulatory requirements

The new regulatory requirements will depend on the analytical capabilities and data availability of the regulated entities. According to the ITS developed by EBA regarding Pillar III, institutions are required to disclose:

- Qualitative information on ESG risks.

- Quantitative information on

- Climate change transition risk,

- Climate change physical risks,

- Mitigating actions and exposures.

On the other hand, under SFDR, market participants and financial advisers are required among others to be transparent on:

- Sustainability risk policies.

- Adverse sustainability impacts at the entity level.

- The remuneration policies concerning the integration of sustainability risks.

- The integration of sustainability risks.

- Adverse sustainability impacts at the product level.

- ESG characteristics in pre-contractual disclosures.

- The promotion of ESG characteristics and sustainable investments.

The standard presentation of such information would be ensured through the ESAs’ developed RTS, which prescribes specific guidelines on the content, methodologies and presentation of the information required to be disclosed.

Additionally, when referring to an entity, financial market participants shall provide the legal entity identifier (LEI) and similarly for a financial product the international security identification number (SIN).

5. Application timeframes

Proposed ITS on Pillar III disclosures about the ESG risks and risk-mitigating actions will be annual regarding the first disclosure and semi-annual thereinafter. This suggests that the first disclosure shall take place in 2023 with a reference date of the end of December 2022. Regarding prudential disclosures by investment firms, EBA currently has no mandate to implement them.

The delegated regulation supplementing the SFDR, regarding ESAs’ proposed RTS shall enter into force twenty days following its publication in the Official Journal of the European Union. The regulation shall apply from the 1st of January 2022. RTS reports shall refer to the previous calendar year, except for the first time where no references would be required to previous periods.

Final thoughts

Following the introduction of ESG Regulations, the Cyprus Securities and Exchange Commission (CySEC) published Directive DI87-01(A) for harmonisation with the relevant European directive. The said directive mandates the incorporation of sustainability factors within the product governance obligations of Cyprus Investment Firms (CIF).

Currently, the amendment of the Markets in Financial Instruments Directive (MiFID II), is under review and will allow investors to specify their ESG preferences and oblige entities to consider them.

Furthermore, as suggested by the expected European regulation on Markets in Crypto Assets (MiCA), crypto asset market participants will be required to declare information on their environmental and climate footprint. Such information will be disclosed through RTS developed by the European Securities and Markets Authority (ESMA).

To conclude, we expect European authorities to enforce the consideration of ESG factors and risks in the activities of financial institutions and investment firms, requiring the disclosure of detailed data. This will enable targeted measures to be generated and adopted for the transition to a more sustainable economy.

The SALVUS Regulatory Compliance and Risk Management teams carry first-hand experience in the implementation of newly introduced regulatory requirements. They support regulated entities in creating and establishing the appropriate policies and procedures, as well as fulfilling their reporting obligations, to achieve full compliance.

Please contact us at info@salvusfunds.com or call us at +357 7000 7898 if you have any questions or require support with your obligations under the AML/CFT legislation.

#StayAhead

Should you be interested to read more about the capital requirements of Investment Firms, MiCA or Alternative Investment Funds please visit the selected articles below:

- Establishing an AIF in 2022 in Cyprus

- MiCA and the CySEC CASP regime in Cyprus

- Investment Firms New Capital Requirements (IFR & IFD)

The information provided in this article is for general information purposes only. You should always seek professional advice suitable to your needs.