Providing Investment Advice & Portfolio Management under MiFID

In the ever-evolving and highly regulated space of investment services, the provision of investment advice and portfolio management on a professional basis in and from the European Union requires prior authorisation under MiFID. Investment advice and portfolio management are regarded as core investment activities, encompassing a broad spectrum of financial instruments including transferable securities, derivatives and contracts for financial differences (CFDs).

Throughout this article the SALVUS Regulatory Compliance team discusses the investment services of Investment Advice and Portfolio Management. We elaborate on the obligations that MiFID-regulated entities must adhere to when providing these services. The article focuses on the following key areas:

1. Understanding Investment Advice

2. Exploring Portfolio Management

3. Conducting Suitability Assessment: KYC & KYP

4. Establishing an Investment Policy

We regularly share bite-sized insights on LinkedIn such as those found in this article

1. Understanding Investment Advice

Investment advice involves offering personalised recommendations to a client, either at their request or initiated by the investment firm, concerning one or more transactions related to financial instruments. The crucial aspect is that this service qualifies as investment advice only when it constitutes a personal recommendation. This distinction is pivotal, as it draws a line between offering advice and merely providing information.

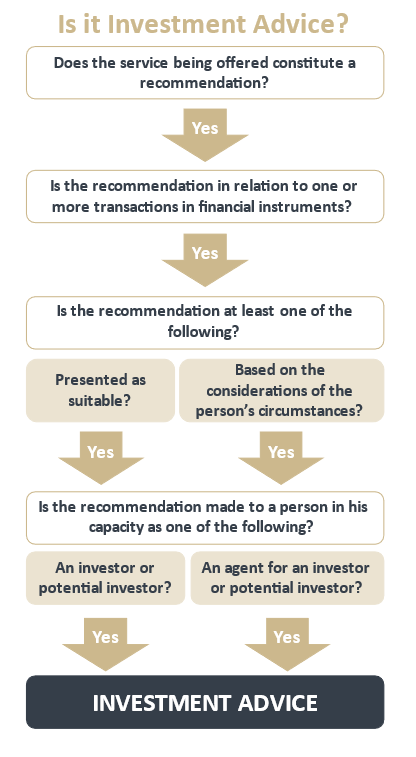

While a firm may not intend to provide a recommendation to a client, it should be mindful that a recommendation can sometimes be implied indirectly. To help firms navigate this distinction, the following decision diagram outlines straightforward steps for determining whether the information being provided qualifies as investment advice.

2. Exploring Portfolio Management

Portfolio management involves the management of portfolios according to client mandates on a discretionary, client-by-client basis. These portfolios may consist of one or more financial instruments. The primary goal of a Portfolio Manager is to operate in alignment with the investment policy established between the client and the firm. This policy outlines the client’s investment objectives and constraints.

The investment policy is subject to regular review, as agreed upon by the firm and the client. If there are changes to the client’s investment objectives or constraints before the scheduled review, it is the client’s responsibility to promptly inform the Portfolio Manager of these changes.

3. Conducting Suitability Assessment: KYC & KYP

The process of suitability assessment requires the collection of information about a client and the subsequent assessment by the firm to determine whether a particular investment product is suitable for the client. Thus, the persons responsible for providing investment advice or portfolio management shall possess a deep understanding of the products they can recommend or invest in on behalf of the client. This process combines elements of Know Your Customer (KYC) and Know Your Product (KYP) practices.

As a common market practice, firms often employ a suitability assessment questionnaire. This questionnaire typically covers the client’s:

- investment history and current asset allocation,

- trading experience and investment knowledge,

- risk tolerance and restrictions, and

- investment objectives and constraints.

Investment firms have a responsibility to inform their clients clearly and simply about the suitability assessment’s purpose, which is to ensure that the firm acts in the client’s best interest. This communication should include an explanation that conducting the assessment is the firm’s responsibility and emphasise the importance of keeping the information up-to-date, accurate, and complete.

The suitability assessment questionnaire can be provided in a standardised format, facilitating controls to verify the information provided. It is crucial for firms to avoid implying that a specific financial instrument is the client’s choice of suitability or requiring the client to confirm the suitability of an instrument.

When establishing or enhancing a suitability assessment questionnaire firms must ensure that the questions asked are specific enough and are likely to be understood correctly. The imprecise and excessively technical language shall be avoided. Additionally, the questionnaire’s layout should be carefully elaborated, to avoid orienting investors’ choices.

Mirroring MiFID, the Markets in Crypto Assets (MiCA) regulation prescribes the provision of investment advice and portfolio management on crypto assets. Thus, Crypto-Asset Services Providers (CASP) are required to establish and implement a similar suitability assessment procedure.

4. Establishing an Investment Policy

The investment policy statement serves as a binding agreement between the firm and the client, providing a clear outline of the client’s investment mandates for the Portfolio Manager to follow. The firm is responsible for presenting the client with the investment universe of financial instruments in which the Portfolio Manager will conduct investments and trades, forming the client’s portfolio.

Within this context, the client is required to specify its investment restrictions, including the percentages of long and short positions that the Portfolio Manager should apply for specific assets. The Investment Policy should also outline any circumstances under which the Portfolio Manager may deviate from the client’s investment restrictions.

Furthermore, the investment policy statement should educate the client about the risks associated with receiving Portfolio Management services. These risks encompass general factors such as political, economic, and market risks, as well as risks specific to the firm, such as counterparty risk, and risks specific to the assets, such as liquidity risk.

Changes to the investment policy statement should occur at regular and predetermined intervals, as agreed upon between the firm and the client. If the client wishes to make amendments earlier due to changes in the investment objectives and constraints, they should directly communicate these changes to the Portfolio Manager.

Final thoughts

We firmly believe that the provision of investment advice and portfolio management services necessitates the establishment of highly sophisticated procedures, primarily reliant on skilled and knowledgeable employees. As the European Union transitions to a greener and more sustainable economy, investment products and services may become increasingly complex and difficult for investors to understand.

Nonetheless, it is the duty of regulated investment firms to ensure the adoption of appropriate policies and procedures while providing information that is fair, clear and non-misleading. The implementation of an effective suitability assessment, as well as a well-defined investment policy constitute critical requirements for the provision of investment advice and portfolio management.

The SALVUS Regulatory Compliance team stands ready to support investment firms in achieving regulatory compliance. The team holds extensive expertise in the development and enhancement of policies and procedures, to ensure alignment with the MiFID standards. Furthermore, our actions are geared towards optimising operations in consideration of our clients’ unique business models and requirements.

Contact us at info@salvusfunds.com if you have questions about the provision of Investment Advice and Portfolio Management services or if you require support with your regulatory obligations.

#StayAhead

Should you be interested to read more about Sustainable Finance, MiCA Regulation or AML Compliance, please visit the selected articles below:

- The Roadmap to Sustainable Finance: ESG, EU Regulations, and Impact

- MiCA Regulation: Embarking on a new era for Crypto-Assets & CASP

- AML compliance for CySEC regulated entities

The information provided in this article is for general information purposes only. You should always seek professional advice suitable to your needs.