Navigating the Prop Trading Landscape Core Services and Regulatory Considerations

In today’s dynamic world of retail proprietary trading, firms present traders with clearly defined risk and reward objectives, then invite them to trade on demo or simulated accounts under a separate performance-based payout agreement (marketed as “profit share,” “bonus,” or “reward”). Since traders contribute no capital, many of these models sidestep traditional investment services licensing. Nevertheless, this evolving structure is drawing heightened scrutiny, particularly around marketing fairness, clarity for consumers, and transparency in contractual terms.

In this article, the SALVUS Regulatory Compliance team explores the prop trading for the upcoming possible licensing framework through the following:

1. The model and its attractiveness

2. How do most firms operate legally?

3. Known & Emerging Regulatory Focus

4. How can SALVUS assist you?

We regularly share bite-sized insights on LinkedIn such as those found in this article.

1. The model and its attractiveness

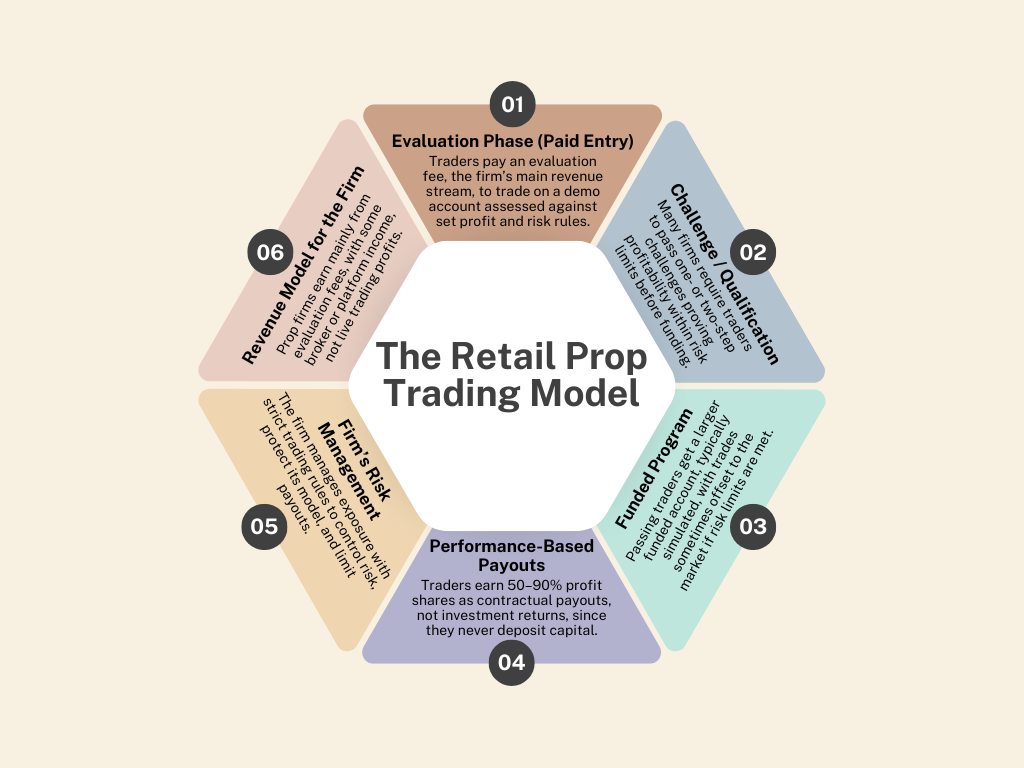

The Retail Prop Trading Model gives traders access to capital without depositing their own funds by completing a paid evaluation. Traders trade on simulated accounts and are tested against rules such as profit targets, drawdowns, and consistency requirements. Successful candidates progress to a funded account, usually still simulated but monitored through firm risk systems, with some trades occasionally offset to the live market. Profitable traders receive contractual payouts of 50%–90%, which are rewards rather than investment returns since no client money is involved. For firms, revenue mainly comes from evaluation fees, making the model scalable, predictable, and appealing to both firms and traders.

2. How do most firms operate, legally?

Prop trading evaluation programs are legally structured as simulation-based services rather than regulated brokerage or investment offerings, with trading conducted exclusively in demo environments using fictitious funds. While marketed as “funded” opportunities, these accounts remain simulated, and payouts are framed as performance-based rewards under private agreements, not returns on client capital. Importantly, the entity that administers the evaluation is often distinct from the one issuing the funded program agreement or handling payouts, creating separation in responsibilities and jurisdictions. This makes it essential for participants to understand which entity they are contracting with, under what governing law, and how fees, payments, and obligations are managed, ensuring clarity, compliance, and realistic expectations of how the model operates.

Legal Distinctions Between Evaluation Providers and Funding Entities

It is common practice for the funded program agreement to be issued by a different entity than the one that sells the evaluation, creating a separation between fee collection and payout administration. In many cases, the evaluation provider and the entity responsible for managing the funded program are legally distinct. Participants should always verify which entity is responsible for payments and under which jurisdiction the agreement is governed, to ensure clarity on rights, obligations, and applicable law.

Legal and Operational Overview of Simulation-Driven Prop Models

Legally, the program is framed as a simulation-and-evaluation service delivered through a proprietary platform, where all trading activity takes place in a simulated environment using fictitious funds for educational and assessment purposes. The provider’s Terms & Conditions describe the Evaluation as “a simulated training environment,” and disclaimers across the site emphasize that trades executed on the platform are simulated and do not represent real trading results. Upon completing the paid evaluation and passing KYC/KYB checks, participants may be offered “Funded User” status under a private agreement governed by the Terms, though trading within the platform continues to be simulated. Program materials (such as challenge phases) clarify that these stages run on demo accounts, with profit-sharing payouts only available once the funded level is reached. Payouts are processed in accordance with the provider’s help center policies, such as bi-weekly withdrawals after funding.

Non-Broker Model: Legal and Operational Overview of Evaluation Services

The provider is not a broker or investment firm. Its Terms of Service clarify that none of its offerings constitute investment services and that registration fees apply solely to participation in the evaluation. All challenges are conducted on simulated accounts, and even “funded” accounts are described as simulated, with trading execution taking place within the provider’s infrastructure using aggregated market data. The firm specifies that it does not rely on external retail brokers. Payouts are characterized as performance-based rewards, available after passing identity verification checks (KYC), rather than returns on client funds, since participants do not deposit trading capital. The legal documentation also outlines the governing law for the service and lists jurisdictional restrictions on who may access it.

From Evaluation to Payout: Understanding the Prop Trading Experience

The provider operates as a simulation-and-evaluation service rather than as a broker accepting client deposits or offering investment services. Participants first complete an evaluation program, and upon passing KYC/AML checks, may be offered a “funded account” under a private agreement. This account remains fully simulated, using demo environments with real-time market quotes. The provider notes that trading data may, at its discretion, be mirrored to a partnered proprietary trading entity, though the participant’s own account continues to be simulated. Payouts are issued under the terms of the private agreement after identity verification. The platform includes standard disclaimers highlighting the simulated nature of performance results and makes clear that it is not a regulated broker and does not handle client trading capital or provide investment services.

3. Known & emerging regulatory focus

The regulatory and operational environment for retail proprietary trading firms is becoming increasingly complex across multiple jurisdictions. In the EU, CySEC and ESMA are signalling stricter oversight, emphasizing investor protection, transparency, and compliance. In the UK, firms must ensure financial promotions meet post-2024 s21 gateway requirements, while the ASA monitors misleading claims around profits and trading representations. In the US, cases like the My Forex Funds litigation highlight ongoing scrutiny of trade execution, payouts, and representations. At the same time, technology and venue changes can disrupt operations, making platform contingency and geo-compliance critical for both regulatory adherence and uninterrupted trading.

- Cyprus /EU direction of travel.

CySEC’s Chair has indicated that retail proprietary trading firms will “probably, at some point” come under a comprehensive and robust regulatory framework, while ESMA has already conducted preliminary assessments. Although no specific timelines have been established, regulatory scrutiny is intensifying, reflecting a growing emphasis on investor protection and heightened expectations for transparency, compliance, and operational integrity within the retail prop trading sector.

- United Kingdom: promotions discipline.

Even if a proprietary trading firm is not FCA-authorised, any financial promotions directed at UK residents must comply with the post-2024 s21 gateway, meaning they require approval by an FCA-authorised approver or must be appropriately geo-restricted. Additionally, the Advertising Standards Authority (ASA) is actively monitoring and challenging misleading claims for unregulated products. Firms should take care to avoid language that implies live trading with client funds, guarantees of profit, or exaggerated win rates, ensuring that all marketing materials are clear, transparent, and compliant with UK regulatory expectations.

- United States: futures/CFD sensitivities.

The My Forex Funds litigation concluded with a dismissal with prejudice and sanctions imposed on the CFTC; however, this outcome addressed agency misconduct rather than providing a judicial endorsement of the firm’s business model. Regulatory scrutiny in the United States remains high, particularly regarding how proprietary trading firms represent live versus simulated trading, trade execution practices, and payout procedures, underscoring that compliance and transparency continue to be critical for operating within the US market.

- Australia (ASIC)

An area for future focus for ASIC is the distribution of CFDs by issuers via emerging channels, such as ‘prop trading’ services. In 2024/25, the regulator planned to undertake detailed surveillance of new and emerging distribution methods across the CFD industry and review consumer outcomes.

4. How can SALVUS assist you?

The SALVUS Funds Licensing team helps retail proprietary firms to properly set up in the current regulatory framework, and also be prepared for the possible regulatory requirements with clarity and confidence. Drawing on expertise across EU, UK, and US regimes, we deliver tailored solutions for licensing, governance, reporting, and operational compliance.

We guide you through the full authorization process from gap analysis and license applications to regulator communications while ensuring alignment with capital and prudential standards. Beyond licensing, we establish the compliance infrastructure regulators expect, including AML/KYC, governance frameworks, policy manuals, and the appointment of key function holders.

As a long-term partner, SALVUS provides regulatory horizon scanning, remediation support, and strategic guidance to help future-proof your business model.

Contact us at info@salvusfunds.com if you would like more information about Retail Proprietary trading firms. We are always ready to answer your questions and support you in achieving regulatory compliance.

#StayAhead

Should you be interested to read more about relevant topics in the prop trading firm, feel free to visit our earlier news and articles:

The information provided in this article is for general information purposes only. You should always seek professional advice suitable to your needs.