L

icensing, Compliance

& Internal Audit

FOR PAYMENT & ELECTRONIC MONEY INSTITUTIONS, INVESTMENT FIRMS, INVESTMENT FUNDS AND CRYPTO-ASSETS SERVICES PROVIDERS

We are here to guide you in finding the best jurisdictions and in complying with the relevant regulations.

Welcome to SALVUS Funds, a boutique advisory devoted to its clients, associates and partners.

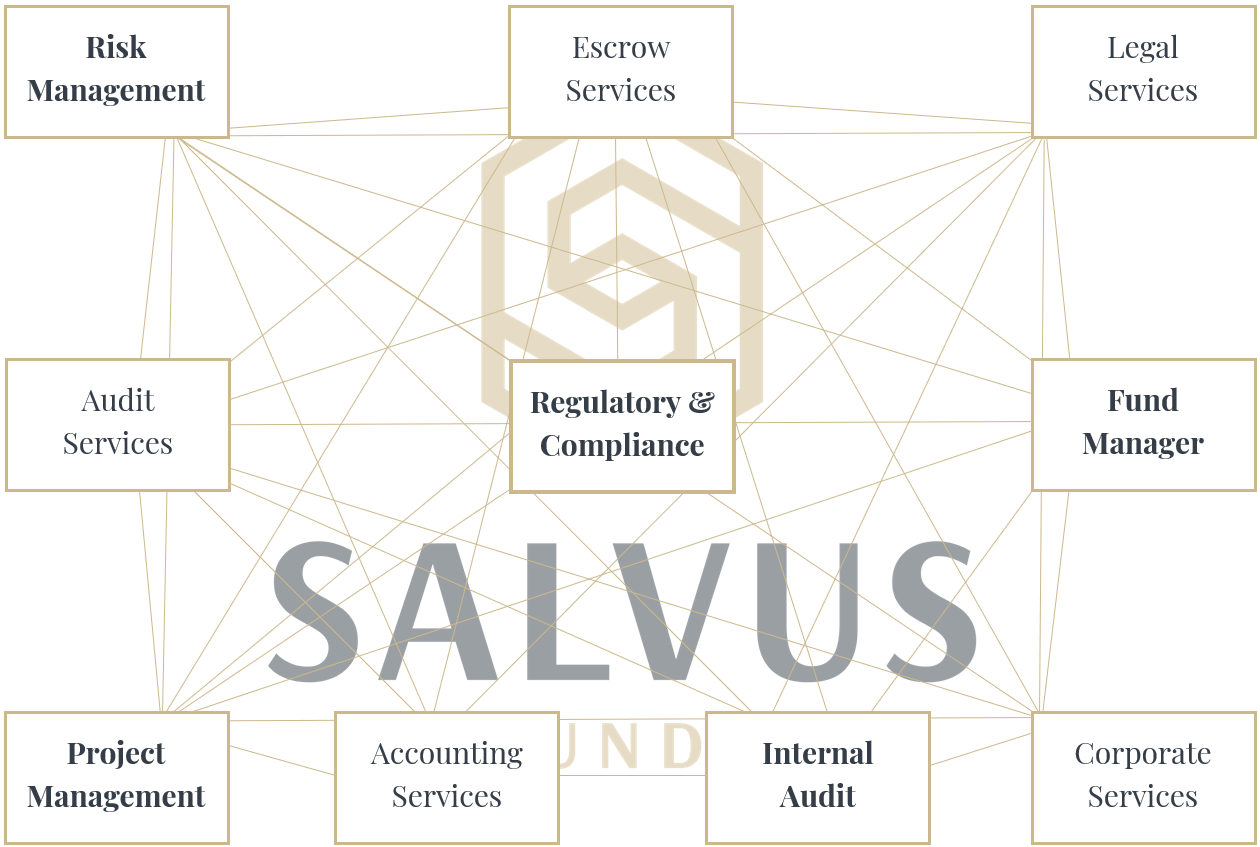

Our team carries vast experience in all matters of licensing, compliance, internal audit, risk management, and operations for Electronic Money (EMI) and Payment Institutions, investment firms, investment funds, and Crypto-Asset Services Providers (CASP).

Our primary goal is to understand your specific challenges and overcome them by working together. We look at every task from a different perspective and that enables us to find solutions for you. Thus, we style ourselves as problem solvers.

#StayAhead is our motto and it encapsulates our attitude and belief in how we should perform for us and for our clients. The idiom is a public pledge that unifies all our brand touchpoints and our source of inspiration for what strive to deliver.

We already mentioned styling ourselves as problem solvers – problem solvers for EMI, CASP, investment firms, investment funds, related M&A deals, licensing issues and MiFID compliance challenges.

Working with EMI, CASP, investment firms and investment funds, our team carries first-hand experience, in helping senior management and stakeholders with virtually any challenge the business might be facing.

Imagine our involvement ranging from supporting you in building new teams or strengthening existing teams through training and knowledge sharing to providing ad-hoc answers, or procedures and policies as needed.

We have been the go-to people in all matters relating to licensing, compliance, internal audit, risk management, and operations. If you are facing any challenges, talk to us, it will be our pleasure to prove our value.

Our team at SALVUS Funds was:

- The first to submit valid EMIR reports for the newly introduced regulation in 2014,

- The first to submit valid MiFIR reports for the newly introduced regulation in 2018,

- The first to submit a CASP application for the newly introduced CASP regime under the Cyprus Securities and Exchange Commission (CySEC) in 2021,

- The first to submit a successfully tested CIR package in XBRL format to the Central Bank of Cyprus (CBC) in 2021,

- The first to test and successfully submit the newly released prudential supervision reports via CySEC’s new XBRL portal in 2023.

We are recognised as thought-leaders, through the articles we regularly and timely author on key topics.

We are proud to be:

- Members of the Global Institute of Internal Auditors (IIA).

- Member of the Cyprus Institute of Internal Auditors (Cyprus IIA) Research and Training Committee.

- Members of the Cyprus Investment Funds Association (CIFA) and the Association’s Fintech Committee.

- Members of the Cyprus Blockchain Technologies (CBT) think-tank.

- Certified Actuarial Analyst (CAA) by the Institute and Faculties of Actuaries (IFoA).

- Certified Persons and Certified Anti-Money Laundering (AML) Compliance Officers in the Public Register of the Cyprus Securities and Exchange Commission (CySEC).

- Instructors on Compliance, Regulation & Internal Audit at the Institute for Professional Excellence (IforPE).

Absolute dedication, to even the tiniest detail and supreme quality of work in every project, is what you should expect; our aim is to exceed your expectations.

We are here to create and provide value to our team, clients, and partners by answering questions that stimulate innovations, simplify decisions, overcome challenges, and improve procedures in licensing, compliance, and internal audit.

#WeAreSALVUS