Q&A for Implementing the Resolution Reporting (CIR Package)

The Central Bank of Cyprus (CBC) is in the process of implementing the Resolution of Credit Institutions and Investment Firms Law of 2016 (“Law 22(I)/2016”) which transposes the provisions of the Bank Recovery and Resolution Directive (“BRRD”) Directive 2014/59/EU of the European Parliament and of the Council of 15 May 2014. The European Commission Implementing Regulation (EU) 2018/1624 of 23 October 2018, (“the CIR”), laid down the EBA technical standards in relation to the procedures, forms, and templates for the provision of information of resolution plans for credit institutions and investment firms.

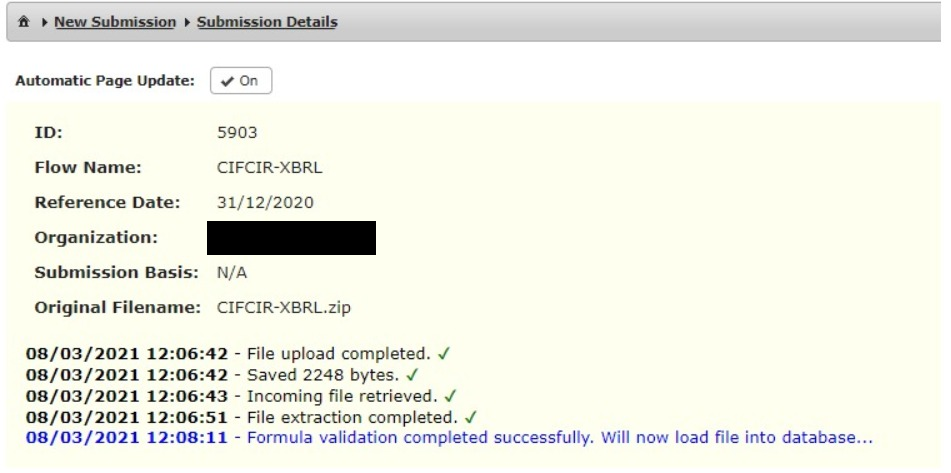

Our team is in the final stage of testing1 the submission of the CIR package in XBRL format with the Central Bank of Cyprus (CBC).

In this commentary, the Risk and Compliance specialist team at SALVUS summarizes our answers, to the most frequent questions we received from our Clients related to the implementation of the CIR package.

1. Which entities in Cyprus fall under the Resolution Reporting?

The regulation applies to all credit institutions and the investment firms that are subject to capital requirements of €730K, by the Cyprus Securities and Exchange Commission.

The said firms are now required to comply with the resolution reporting regulation and submit to the Central Bank of Cyprus (CBC) the “CIR templates”.

It is worth noting that CBC will also maintain the responsibility for the resolution of branches of third-country credit institutions and investment firms that are subject to certain capital requirements (€730K) by the Cyprus Securities & Exchange Commission.

2. What are the CIR templates and what shall be reported?

For the 2021 submissions; the Central Bank of Cyprus (CBC) requires the submission of two reports concerning the reference year 2020.

A. the CIR template “Annotated Table Layout 2100-P2-RES 2.10”, and

B. additional information included in the file named “CIFs Additional Data Templates”.

A. The CIR template “Annotated Table Layout 2100-P2-RES 2.10” form shall be completed as per the guidelines of Annex I and Annex II of the Regulation.

CIFs subject to simplified obligations shall complete only the following sheets:

- Z 01.00 – Organisational structure

- Z 02.00 – Liability Structure

- Z 03.00 – Own funds requirements

- Z 04.00 – Intragroup financial interconnections

- Z 05.01 – Major counterparties (Liabilities)

- Z 05.02 – Major counterparties (off-balance sheet)

- Z 07.03 – Mapping of core business lines to legal entities

* CIFs subject to simplified obligations – meet one of the following criteria according to their latest audited financial statements:

- Total assets are less than €1.000.000.000,

- Total liabilities are less than €1.000.000.000,

- Total income is less than €100.000.000.

B. Only the following sheets shall be completed in the “CIFs Additional Data Template” form:

- Z 05.02a – Other major off-balance sheet counterparties

- Z 05.02b – Off-balance sheet counterparties – Countries

- Z 05.02c – Off-balance sheet counterparties – Sectors

- Z 05.02d – Off-balance sheet counterparties -Type

- Z 05.02e – Clients assets used for Repo/Reverse Repo transactions

- Z 06.00a – Investor Compensation (ICF)

- Z 07.04a – Mapping of Investment Services to Core Business Lines

* It is noted that both reports should be completed in EUR using the ECB rate as of 31/12/2020.

** Where an information item is not applicable to the entities for which the report is submitted, the corresponding field shall be left blank.

3. In which format the CIR templates shall be reported?

The CIR templates must be submitted as follows

- The “Annotated Table Layout 2100-P2-RES 2.10” in XBRL format and with the filename “CIFCIR-XBRL”.

- The “CIFs_Additional_Data_Templates_2021” in excel format and with the filename “CIFADD-EXCEL”.

It is important to note that the XBRL reports shall be produced using the EBA XBRL taxonomy 2.10.

4. When is the deadline and where to submit the CIR forms?

The CIR templates must be submitted to CBC by the 30th of April 2021, through the EDX platform of CBC.

Conclusion

From this year and onwards, the BRRD/CIR package reporting obligation will be added to the CIFs annual reporting obligations.

SALVUS Risk and Compliance team carrying its extensive experience in designing, implementing, and delivering regulatory reporting solutions, is ready to support you to comply with the CIR package forms to convert the required form in the XBRL format. We remain at your disposal and should you have any questions, please contact us at info@salvusfunds.com.

#StayAhead.

1 Our team was the first and only team to submit on time for the then newly introduced EMIR in 2014 and MiFIR in 2018.

The information provided in this article is for general information purposes only. You should always seek professional advice suitable to your needs.