CIR Package – Q&A for Implementing 2022 Resolution Reporting

The Central Bank of Cyprus (CBC), for the second year, is implementing the Resolution of Credit Institutions and Investment Firms Law of 2016 (“Law 22(I)/2016”) which transposes the provisions of the Bank Recovery and Resolution Directive (“BRRD”) Directive 2014/59/EU of the European Parliament and of the Council of 15 May 2014. The European Commission Implementing Regulation (EU) 2018/1624 of 23 October 2018, (“the CIR”), laid down the EBA technical standards in relation to the procedures, forms, and templates for the provision of information of resolution plans for credit institutions and investment firms.

Our team is in the final stage of testing1 this year’s version of submission of the CIR package in XBRL format with the CBC.

In this commentary, the Regulatory Compliance team at SALVUS summarises our answers, to the most frequent questions we received from our Clients related to the implementation of the CIR package.

1. Which entities in Cyprus fall under the Resolution Reporting?

2. What are the CIR templates and what shall be reported?

3. In what format shall the CIR templates be reported?

4. When is the reporting deadline and where to submit the CIR forms?

1. Which entities in Cyprus fall under the Resolution Reporting?

The regulation applies to all credit institutions and investment firms that are subject to capital requirements of €750K, by the Cyprus Securities and Exchange Commission (CySEC).

The said firms are now required to comply with the resolution reporting regulation and submit to the Central Bank of Cyprus the “CIR templates”.

It is worth noting that CBC will also maintain the responsibility for the resolution of branches of third-country credit institutions and investment firms that are subject to certain capital requirements (€750K) by the Cyprus Securities & Exchange Commission.

2. What are the CIR templates and what shall be reported?

For the 2022 submissions; the CBC requires the submission of two reports concerning the reference year 2021.

- the “CIR template” following the EBA taxonomy 3.1, and

- additional information included in the file named “CIFs Additional Data Templates 2021”.

A. The “CIR template” form shall be completed as per the guidelines of Annex I and Annex II of the Regulation.

CIF subject to simplified obligations shall complete only the following sheets:

- Z 01.00 – Organisational structure

- Z 02.00 – Liability Structure

- Z 04.00 – Intragroup financial interconnections

- Z 05.01 – Major counterparties (Liabilities)

- Z 05.02 – Major counterparties (off-balance sheet)

- Z 07.03 – Mapping of core business lines to legal entities

It is worth noting these types of CIF are exempted from completion of all “T type” sheets; ranging from “T 01.00” until “T 98.00”. Additionally, the below fields are exempted from “Z type” sheets and in particular:

- Z 03.00 – Own funds requirements

- Z 06.00 – Deposit insurance (DIS)

- Z 07.01 – Criticality assessment of economic functions (FUNC 1)

- Z 07.02 – Mapping of critical functions by legal entity (FUNC 2)

- Z 07.04 – Mapping of critical functions to core business lines (FUNC 4)

- Z 08.00 – Critical services (SERV)

- Z 09.00 – FMI Services – Providers and Users – Mapping to Critical Functions (FMI)

- Z 10.01 – Critical Information systems (General information) (CIS 1)

- Z 10.02 – Mapping of information systems (CIS 2)

*CIFs subject to simplified obligations – meet one of the following criteria according to their latest audited financial statements:

- Total assets are less than €1.000.000.000,

- Total liabilities are less than €1.000.000.000,

- Total income is less than €100.000.000.

- Only the following sheets shall be completed in the “CIFs Additional Data Template” form:

- Header

- CIFADD 03.00 – Own funds requirements

- CIFADD 05.02a – Other major off-balance sheet counterparties

- CIFADD 05.02b – Off-balance sheet counterparties – Countries

- CIFADD 05.02c – Off-balance sheet counterparties – Sectors

- CIFADD 05.02d – Off-balance sheet counterparties -Type

- CIFADD 05.02e – Clients assets used for Repo/Reverse Repo transactions

- CIFADD 06.00a – Investor Compensation Fund (ICF)

- CIFADD 07.04a – Mapping of Investment Services to Core Business Lines

*It is noted that both reports should be completed in EUR using the European Central Bank (ECB) rate as of 31/12/2021.

**Where an information item is not applicable to the entities for which the report is submitted, the corresponding field shall be left blank.

3. In which format shall the CIR templates be reported?

The CIR templates must be submitted as follows

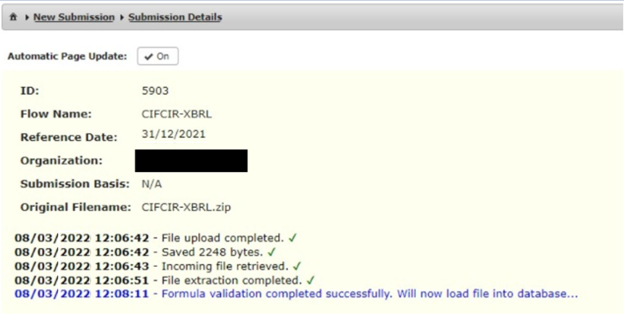

- The “CIR Package” in XBRL format and with the filename “CIFCIR-XBRL”.

- The “CIFs_Additional_Data_Templates_2021” in excel format and with the filename “CIFADD-EXCEL”.

It is important to note that the XBRL reports shall be produced using the EBA taxonomy 3.1, which is replaced from EBA XBRL taxonomy 2.10.

4. When is the reporting deadline and where to submit the CIR forms?

The CIR templates must be submitted to CBC by the 30th of April 2022, through the EDX platform of CBC.

Our Regulatory Compliance team at SALVUS was the first and only team to submit:

- valid EMIR reports for the newly introduced regulation in 2014,

- valid MiFIR reports for the newly introduced regulation in 2018,

- a CASP application for the newly introduced CASP regime in 2021.

- successfully tested and completed the CIR package in XBRL format to the Central Bank of Cyprus in 2021.

The SALVUS Regulatory Compliance team through the FINVUS RegTech platform, stand ready to support you to comply with the CIR package forms. FINVUS carries extensive experience in specifying, developing, and delivering regulatory reporting technology solutions. Our team will convert the required in the XBRL format for their timely submission to CBC. We remain at your disposal and should you have any questions, please contact us at info@salvusfunds.com.

The information provided in this article is for general information purposes only. You should always seek professional advice suitable to your needs.