CySEC, Setting up a CIF, types & application fees

Continuing the series of articles dedicated to Cyprus Investment Firms (CIFs), in this one, we provide details on the different types of CIFs based on their capital requirement and provide complete information on the fees payable to CySEC, accompanied by the CIF application of a new CIF license and the initial contributions to the Investor Compensation Fund (ICF). It is worth mentioning, that the legal framework of the Investors Compensation Fund (ICF) was upgraded no less than 6 months ago, introducing new fees and other changes.

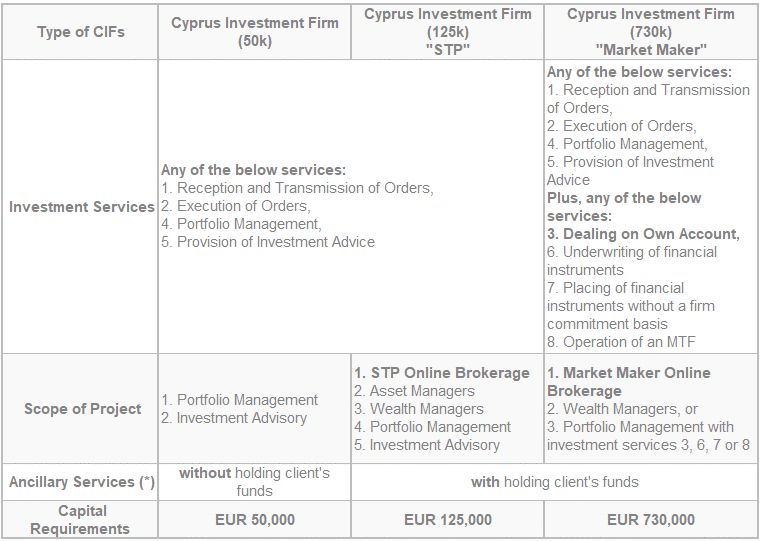

The different types of CIFs available for license by CySEC

The minimum capital required in order to operate a CIF with a CySEC license is depended on the investment services and ancillary services the firm apply for within the application, that suit the business model and objectives. A detailed description of the investment and ancillary services can be found here.

Most of the companies currently licensed under CySEC are brokerages offering access to online trading of financial instruments in the form of Contracts of Difference (CFD). Others are Asset Managers and Wealth Managers, with a few also or solely performing Portfolio Management and Investment Advisory.

There are two types of online brokerages, both holding clients’ funds;

- Straight through processing (STP) brokers: where the broker transmits ALL orders to the market, without the CIF holding any market risk in its books.

- Market Maker (MM) broker: the CIF can deal on own account and according to its risk management mandate can hold part or ALL of the market risk arising from clients’ orders.

* The ancillary service that allows the CIF to hold clients’ funds is: Safekeeping and administration of financial instruments for the account of clients, including custodianship and related services such as cash/collateral management and excluding maintaining securities accounts at the top tier level.

** Ancillary services can be provided only in combination with investment services.

The minimum capital required must be in a liquid form of investment. The applicant must show evidence of the required capital plus the first years’ budget from the business plan for the set-up and the operation of the CIF.

A quick rule to summarize the above table for online brokerages is

- a firm Dealing on Own Account or offering underwriting has a capital requirement of EUR 730,000

- a firm not offering the services mentioned in (a) BUT holding clients’ funds then the capital required is EUR 125,000

- for all other it is EUR 50,000 (i.e. not dealing on own account, not offering underwriting and not holding clients’ funds)

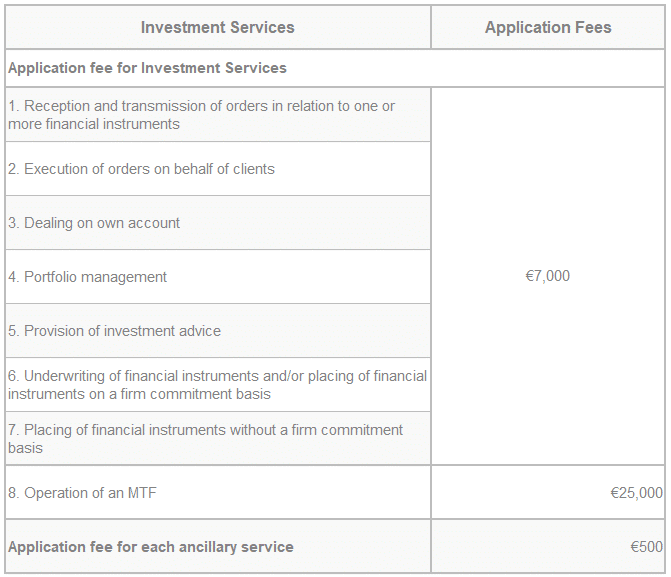

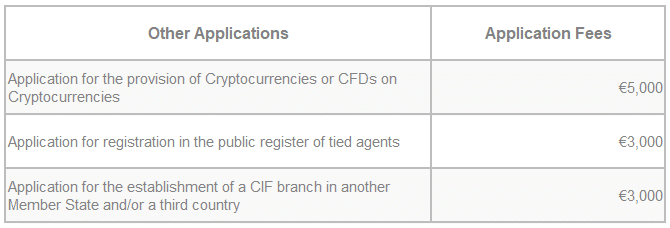

Application fees payable to CySEC

The applicable fees to be paid to CySEC along with the application for a CIF license for the respective investment and ancillary services, and the fees for other applications, as per the Directive DI87-03, are listed below.

Initial contribution payable to the ICF

The legal framework of the investor compensation fund (ICF) was upgraded in March 2019, introducing many changes including on the initial contribution payable to the ICF.

The initial contribution is changing, and the following applies to CIFs;

- €2.000 per investment service,

- €35.000 for the safekeeping ancillary service.

Changes concerning the initial contribution are;

- The new applicant members of the ICF must pay the initial contribution for their registration to the ICF, once they receive (and not before) the written direction on the final steps for authorization from CySEC.

- The initial contribution (excluding the costs of the transaction) is returned to the applicant only if the application is rejected by CySEC and in light of any new information.

- The initial contribution made to the ICF will not be returned after the member renounces its license.

* For the members that entered the ICF prior the issuance of the directive in March 2019, the funds will be kept under the members account and the unutilized balance will be returned upon the member renouncing its license and after resolving of any pending claims.

More details of the legal framework of the investor compensation fund can be found in our article published in March 2019.

We remain at your disposal if you require further information related to the licensing process of a CIF, any specific point within this article or other questions regarding topics such as capital requirements or regulatory compliance do not hesitate to contact us at info@salvusfunds.com

We will be glad to support you in finding a solution appropriate to your business plans that suits your objectives.

The information provided in this article is for general information purposes only. You should always seek professional advice suitable to your needs.