Is it all gloom and doom for hedge funds returns (YTD)?

The first months of 2020 are challenging, to say the least, for portfolio managers and in continuation of our articles on investment funds, within this article the team at SALVUS briefly discusses

- The year-to-date (YTD) performance of hedge funds

- Looking deeper into a hedge fund recording profits

- Correlation, diversification and performance

- How to judge a portfolio manager

- Post-pandemic performance

The year-to-date (YTD) performance of hedge funds

Is it all gloom and doom for hedge funds returns? The answer is no, there are hedge funds recording positive returns and one identified further below, doing particularly well. Nonetheless, lets first look into the bigger picture.

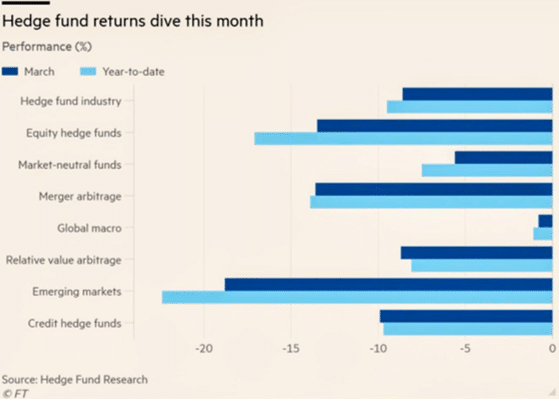

Recently the Financial Times, using data from the HFR (Hedge Funds Research), painted a pretty bleak picture for the performance of various hedge funds categories. As shown in Figure 1, all eight reported categories had a negative return in March, and this is no surprise given the limitations the Covid-19 coronavirus has imposed on economies and societies across the globe. This performance in turn, pushed the year-to-date performance (YTD) in the red.

Figure 1 – Source: Hedge Funds Research – ft.com

The best performing category, in other words the one recording the smallest negative returns, is Global Marco, and the worst performing are the Emerging Markets hedge funds with a drawdown of nearly 20% in March.

Looking deeper into a hedge fund recording profits

So, which hedge funds are recording profits?

The data reported by FT.com, are industry wide, meaning the individual performance of individual hedge funds certainly varies. We have reached out to our network of portfolio managers to get a better feel on their performance. Although there are a few with positive returns, we have identified one particularly over-performing its peers.

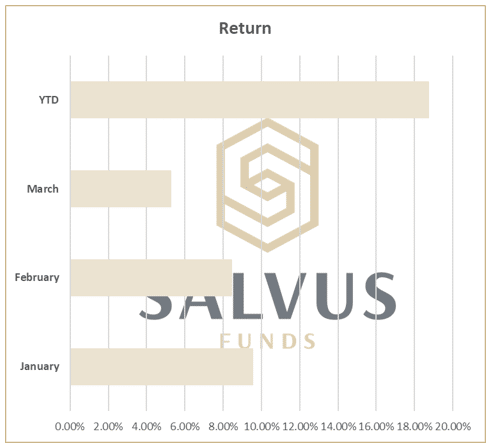

Figure 2 captures the first quarter monthly returns of this hedge fund. Their compounded return for its YTD performance is slightly above 18%, which is on the exact opposite spectrum from the majority of investment funds in YTD terms.

Figure 2 – Positive returns at the times of Covid-19

Correlation, diversification and performance

The reason so many categories of hedge funds, employing different methodologies in different markets, are performing similarly is correlation.

Risk management and portfolio theory have a long demonstrated the value of diversification as a risk management strategy. The rationale behind this is that a portfolio made up of different kinds of assets yields higher long-term returns on average, while lowering the risk from individual components.

When an event such as the Covid-19 pandemic comes out, it confounds all expectations. It is for this instances that back in 2007, Nassim Nicholas Taleb popularised the term of black swans. In plain terms, simply because you haven’t seen a black swan, it does not mean it does not exist. In shocks such as the one caused by the lockdowns in nearly a quarter of the world, it is apparent that diversification cannot do better than what Figure 1 captures and the correlation between the different hedge funds strategies increases in these times, pulling them all to one direction. This is because you cannot model such a level of uncertainty – you probably do not have enough data to start with.

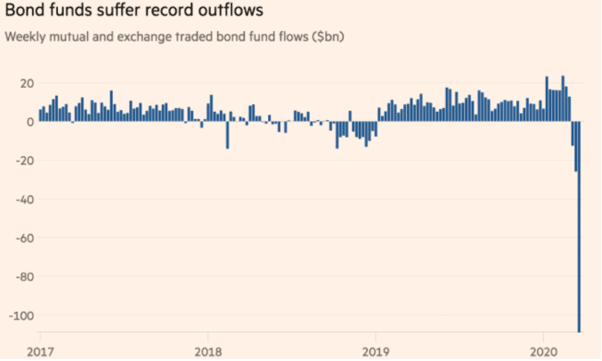

The bond funds outflows in the last 3 months, as shown in Figure 3, are gigantic, possibly making liquidity and thus price discovery for portfolio managers an impossibility.

Figure 3 – Source: ft.com

How to judge a portfolio manager

Back to our over-performing fund.

Before looking into the investment strategy and the portfolio manager, the judging of any hedge fund should start with its credibility. This should translate into the jurisdiction where the investment fund is regulated as well as to which investors it is for. In this case, the hedge fund is regulated in Cyprus by CySEC, a jurisdiction that has been the fastest-growing funds jurisdiction in Europe, under the pan-European regulatory framework and it is for well informed and professional clients.

Moving on, this is an emerging FX fund with an algorithmic trading strategy. This made its team of experienced portfolio managers able to take advantage of both directions the market may take, making the most of the volatility. Therefore, a second step, would be to understand the investment strategy employed and feel comfortable with the experience and the track record of the team involved.

Additionally, this is an FX fund, dealing with the most liquid of asset classes, and could not have found itself in any sort of liquidity or price discovery issues (see Figure 3). A third step then would be to appreciate the fundamental characteristics of the underlying asset class.

Finally, there are 3 key statistics beyond the return of an investment fund, that in our opinion truly paint the full picture of a hedge fund’s performance and they are the final step into properly judging a portfolio manager:

- The Sharpe Ratio is the average return earned in excess of the risk-free rate per unit of volatility. It demonstrates to the investor the return on an investment compared to its risk.

- The Sortino Ratio is similar to the Sharpe Ratio, with the difference that it only considers the downside risk resulting from volatility. Since positive returns from volatility are beneficial, the Sortino Ratio ignores them and it is thus considered to better capture the risk-adjusted performance.

- The Maximum Drawdown is the maximum recorded loss for an investment fund from a peak to a bottom. It is an indication of the downside risk involved over a specified time period and it posts a question to potential investors – “do you feel comfortable with that?”.

Post-pandemic performance

There is one thing in common with all the recorded pandemics in global history and that is, they passed.

While we do not know when and what exactly will change during this crisis, we know that in all other cases where the globe was attacked by a crisis as such, it was at some point eventually over. And once it was over a boom followed. Therefore, stay positive, manage your risk and #StayAhead.

Please, do not hesitate to contact us if you require further information. We will be glad to support you in finding a solution appropriate or answering your questions.

Should you be interested to read about relevant topics of the Cyprus funds sector, feel free to visit our earlier articles:

• The Reasons AIFM, AIF and RAIF come to Cyprus

• The Cypriot AIF: legal forms, types and requirements

• The Cypriot RAIF: substance, requirements and tax

• The latest Cyprus Investment Funds Statistics – February, 2020

The information provided in this article are publicly available in the relevant databases and are for general information purposes only. You should always seek professional advice suitable to your needs.