Cyprus Investment Funds Statistics – August, 2020

The Statistics Department of the Central Bank of Cyprus (CBC) released its August 2020 statistics update for Investment Funds based in Cyprus. The reporting frequency is quarterly, and the current data set period includes data until the end of June 2020. This particular set of data captures the second part of the first wave of the Covid-19 impact, which saw global markets crash within February, partly recovering within March and having a noticeable impact in the investment funds industry in Cyprus at that point in time.

The statistics are presented into the following 5 tables:

1. Investment funds balance sheet data: assets,

2. Investment funds balance sheet data: liabilities,

3. Investment funds total assets/liabilities, by nature of investment,

4. Investment funds total assets/liabilities, by type of investment fund,

5. Investment funds total assets/liabilities, UCITS/Non-UCITS breakdown.

1. The Investment funds balance sheet data: assets table

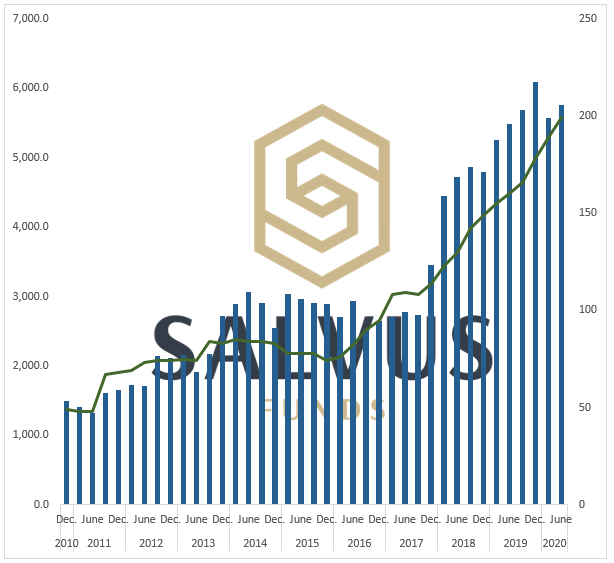

The total assets outstanding at the end of June 2020, were reported at 5,760.6 million EUR. This is a 3.5% increase following, the previously release which reported the first decrease in over 2 years – since the end of December 2018 – for the period ending in March 2020. At that time, the statistics reported by the Central Bank reported a drop of -8.7% in total assets in Investment Funds in Cyprus. The uptick in this report is important as it demonstrates resilience in the investment funds in Cyprus along with the fact that at nearly 5.8 billion EUR is the 2nd highest all time Assets Under Management (AUM) for the Cypriot jurisdiction. The 6 billion plus EUR AUM reported at the end of December 2019, is the highest AUM recorded and it will be interesting to see how long and when that record will be surpassed.

The data on the number of reporting entities recorded another increase – the 11th consecutive quarter-over-quarter increase – solidifying the industry-wide perception of steady and well-founded trend of growth for investment funds in Cyprus. This growth trend has resulted in 199 entities at the end of June 2020 from 189 at the end of March 2020 – an increase of 5.3%. Out of these 10 new entities, 5 are RAIF (Registered Alternative Investment Funds).

Figure 1 below, combines these 2 data sets with

- the y-axis on the left and the bars along the x-axis showing the Total Assets in EUR million, outstanding,

- the y-axis on the right and the line along the x-axis showing the Number of Reporting Entities,

at the end of each period.

Figure 1 – The progress of Total Assets in EUR million (bars), outstanding at end of period and the Number of Reporting Entities (line) since end of December 2010 until end of June 2020.

2. The Investment funds balance sheet data: liabilities table

The breakdown of the liabilities on the balance sheet of Investment Funds in Cyprus is reported in 3 categories by the CBC:

- Loans

- IF (Investment Funds) shares/units

- Other liabilities (incl. financial derivatives)

Most liabilities are coming from IF shares/units, a consistent theme, with 5,002.6 EUR million outstanding at the end of the period (June 2020) amounting to 86.7% of the total liabilities of Investment Funds in Cyprus. Loans follow with a reduced quarter-over-quarter 613.3 EUR million outstanding (10.7%) and finally, other liabilities (incl. financial derivatives) amount to 144.7 EUR million outstanding (2.6%).

3. The Investment funds total assets/liabilities, by nature of investment table

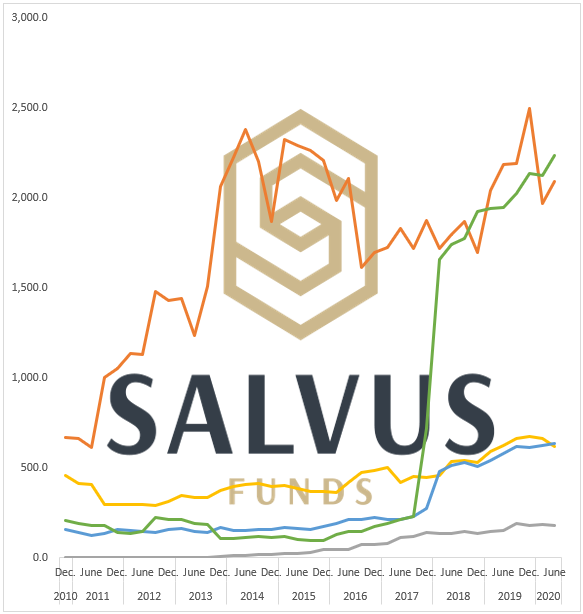

The breakdown by nature of investment of the assets/liabilities on the balance sheet of Investment Funds in Cyprus is collected in 5 categories (Figure 2) by the CBC:

- Equity

- Bond

- Mixed

- Real Estate

- Other

Compared to the end of the previous period (March 2020), Equity, Real Estate and Other recorded an increase while Bond and Mixed decreased. This has pushed Real Estate (blue line in Fig.2) to 3rd place ahead of the Mixed (yellow line in Fig.2) category for the first time in a while. Since the last reporting period, Equity has dropped to 2nd place behind Other. The second biggest asset class, Equity (orange line in Fig.2), reported the biggest increase in outstanding amount terms, 122 EUR million. The total outstanding, for Other (green line in Fig.2) asset class, at 2,236.9 EUR million, is the highest of all time.

4. The Investment funds total assets/liabilities, by type of investment fund table

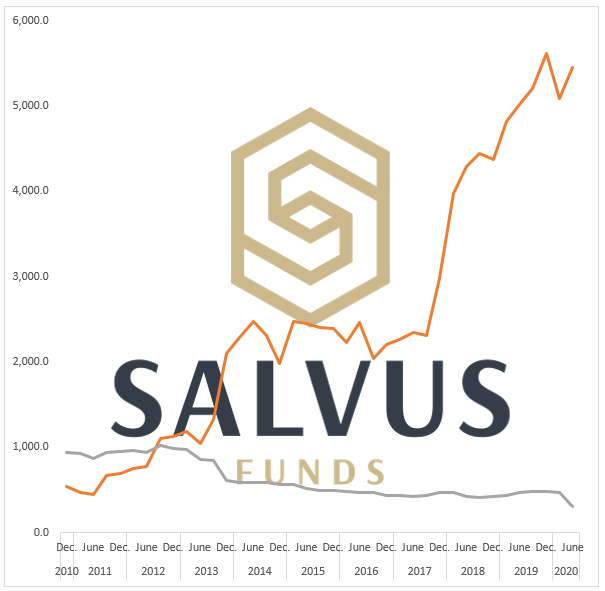

The type of investment funds is split into Open End and Closed End.

As shown in Figure 3, the decrease for Closed End Investment Funds total assets/liabilities continued at a faster pace and an all-time low was recorded at 307.7 million EUR (grey line in Fig. 3), while the increase for Open End (orange line in Fig.3) was 361.2 million EUR bringing the total for the category at 5,452.9 EUR million.

Figure 3 – The progress of the total assets/liabilities in EUR million (bars), outstanding at end of period broken down by type of investment fund.

5. The Investment funds total assets/liabilities, UCITS/Non-UCITS breakdown table

The final table of the Investment Funds Statistics as reported by CBC shows total assets/liabilities for both, UCITS and Non-UCITS investment funds. As reported in our previous commentary on the investment funds in Cyprus, at the end of December 2019, total assets/liabilities for UCITS amounted to 358.6 EUR million outstanding while for Non-UCITS, the total assets/liabilities were reported at 5,735 EUR million outstanding. At the end of March 2020, these have been reduced to 321.6 million EUR and 5,242.3 million EUR for UCITS and Non-UCITS respectively.

Conclusion

The Investment Funds industry in Cyprus, after a very strong 2019, has had a weaker start for 2020 in terms of total assets, yet number of reporting entities continued its increase.

The Covid-19 pandemic halted economic activity like no other event and it is forcing disruptive developments across many different business verticals. While there has been some recovery in the financial markets, there are still many unknowns and key stakeholders such as CySEC and CIFA, the Funds service providers and SALVUS, should welcome creative thinking and an optimistic attitude in facing this crisis as an opportunity. We remain committed to contributing further and aiding in this recovery.

Do not hesitate to contact us if you require further information. We will be glad to support you in finding an appropriate solution or answering your questions.

#StayAhead.

Should you be interested to read about relevant topics on the funds sector, feel free to visit our earlier articles:

- AIFMs & their Risk Management Framework

- AIFMs, UCITs and the Liquidity stress Tests (LST)

- Is it all gloom and doom for hedge funds returns (YTD)?

- The Reasons AIFM, AIF and RAIF come to Cyprus

- The Cypriot AIF: legal forms, types and requirements

- The Cypriot RAIF: substance, requirements and tax

- Cyprus Investment Funds Statistics – May, 2020

- Cyprus Investment Funds Statistics – February, 2020

The information provided in this article is for general information purposes only. You should always seek professional advice suitable to your needs.