Cyprus Investment Funds Statistics – December, 2020

In February 2021, the Statistics Department of the Central Bank of Cyprus (CBC) released its December 2020 statistics update for Investment Funds based in Cyprus. As the reporting frequency is quarterly, the current data set period includes data until the end of December 2020, it effectively reveals the final complete picture for 2020.

This particular set of data captures the fourth chapter of the Covid-19 pandemic impact, which saw

- global markets crash within February,

- partly recovering within March, having a noticeable impact in the investment funds industry in Cyprus at that point in time,

- rallying on the US elections outcome along with news on successful vaccines against the novel coronavirus,

- and most countries in the world experiencing a strong second (or third in some cases) wave of new cases.

The statistics are presented into the following 5 tables:

1. Investment funds balance sheet data: assets,

2. Investment funds balance sheet data: liabilities,

3. Investment funds total assets/liabilities, by nature of investment,

4. Investment funds total assets/liabilities, by type of investment fund,

5. Investment funds total assets/liabilities, UCITS/Non-UCITS breakdown.

1. The Investment funds balance sheet data: assets table

The total assets outstanding at the end of December 2020, were reported at 5,616.8 million EUR. This is a 0.25% increase following the previous report on total assets, which reported a drop in the 3rd quarter following a rebound in June 2020. This 3rd quarter drop was the 2nd quarterly decrease in over 2 years of quarterly increases. This increase in the reported total assets is minimal, yet not negligible, and should be considered in terms of importance along with the overall investment climate. At 5.6 billion EUR this the 4th highest all time Assets Under Management (AUM) for the Cypriot jurisdiction and a mere 400 million from the 6 billion EUR AUM reported at the end of December 2019. It remains to be seen by how much and when that record will be surpassed.

The data on the number of reporting entities recorded yet another increase – the 13th consecutive quarter-over-quarter increase – further cementing the industry-wide view of a rightly accepted upward trend of growth for investment funds in Cyprus. This growth trend has resulted in 222 entities at the end of 2020 from 208 at the end of September 2020 – an increase of 6.7%. The net 14 additional entities is the all-time biggest increase recorded in single quarter and it came about as a result of the registration of 14 new RAIF (Registered Alternative Investment Funds) – the 2nd highest quarterly increase and a vote of confidence in the investment vehicle.

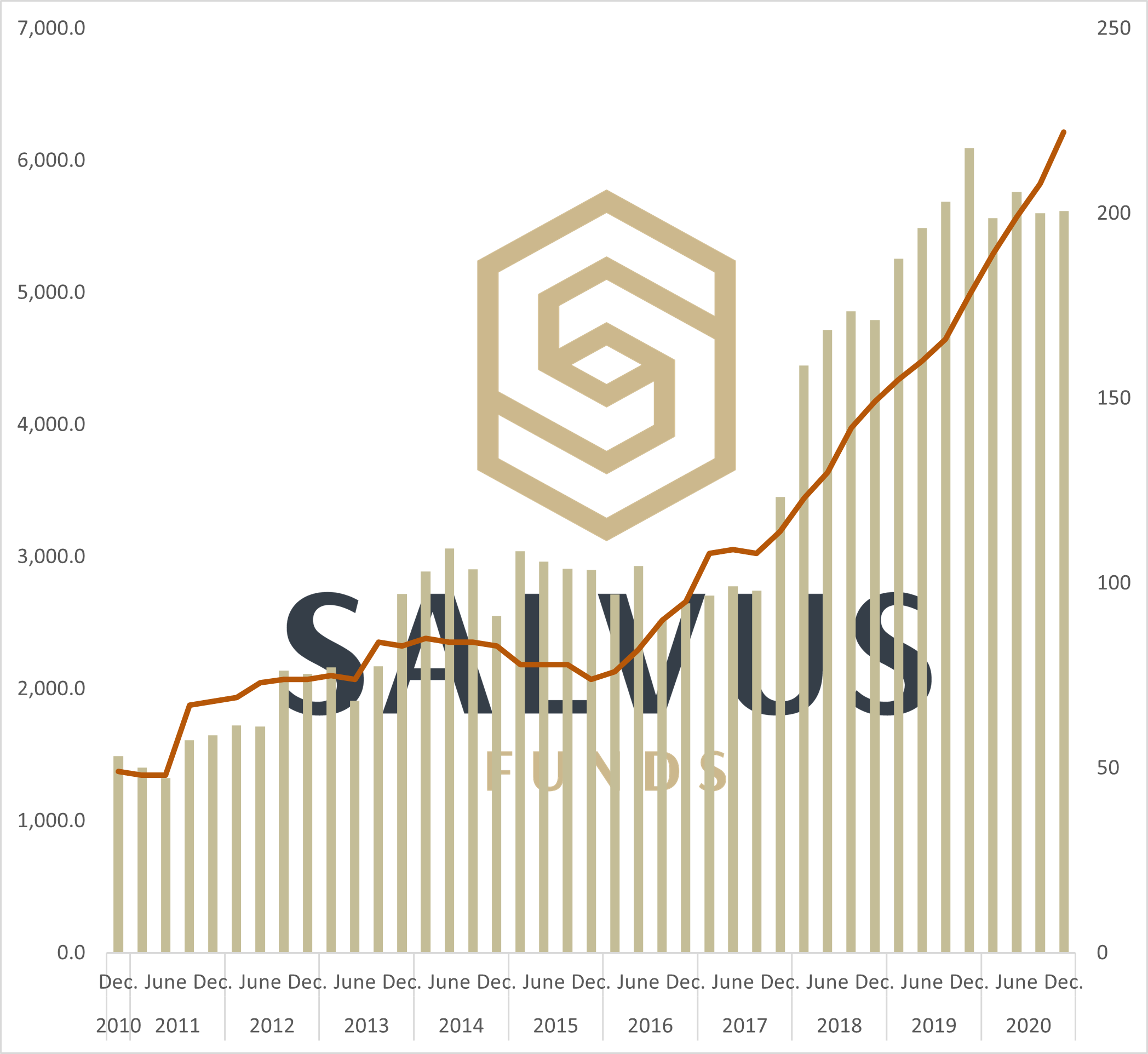

Figure 1 below, combines these 2 data sets with

- the y-axis on the left and the bars along the x-axis showing the Total Assets in EUR million, outstanding,

- the y-axis on the right and the line along the x-axis showing the Number of Reporting Entities,

at the end of each period.

Figure 1 – The progress of Total Assets in EUR million (bars), outstanding at end of period and the Number of Reporting Entities (line) since end of December 2010 until end of December 2020.

2. The Investment funds balance sheet data: liabilities table

The breakdown of the liabilities on the balance sheet of Investment Funds in Cyprus is reported in 3 categories by the CBC:

- Loans

- IF (Investment Funds) shares/units

- Other liabilities (incl. financial derivatives)

Most liabilities are consistently coming from IF shares/units with 4,872.0 EUR million outstanding at the end of December 2020 amounting to 86.7% of the total liabilities of Investment Funds in Cyprus. Loans follow with an increase quarter-over-quarter at 618.3 EUR million outstanding (11%) and finally, other liabilities (incl. financial derivatives) amount to 126.5 EUR million outstanding (2.3%).

3. The Investment funds total assets/liabilities, by nature of investment table

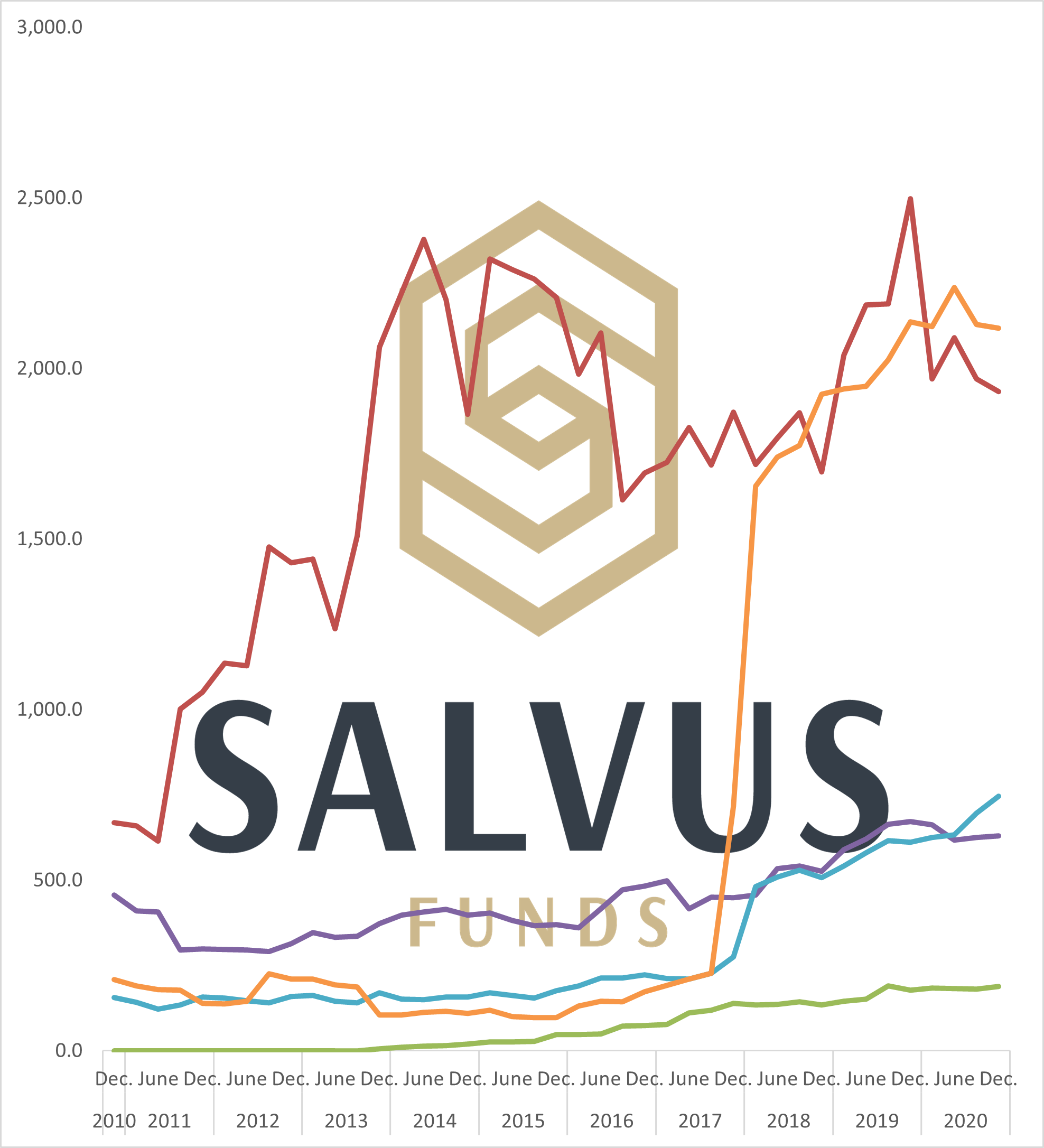

The breakdown by nature of investment of the assets/liabilities on the balance sheet of Investment Funds in Cyprus is collected in 5 categories (Figure 2) by the CBC:

- Equity

- Bond

- Mixed

- Real Estate

- Other

Compared to the end of the previous period in December 2020, Real Estate, Bond and Mixed recorded an increase while the categories of Equity and Other decreased. This has maintained Real Estate (blue line in Fig.2) as the 3rd biggest category ahead of the Mixed (purple line in Fig.2) category. The Real Estate category grew by nearly 7% quarter-over-quarter and has surpassed the 700 million EUR barrier for the first time, at 745.7 EUR million. Equity remains in 2nd place behind Other. The second biggest asset class, Equity (red line in Fig.2), reported a decrease, in outstanding amount terms, of 36 EUR million. The total outstanding, for Other (orange line in Fig.2) asset class, was recorded at 2,118.6 EUR million.

Figure 2 – The progress of total assets/liabilities in EUR million (bars), outstanding at end of period broken down by nature of investment.

4. The Investment funds total assets/liabilities, by type of investment fund table

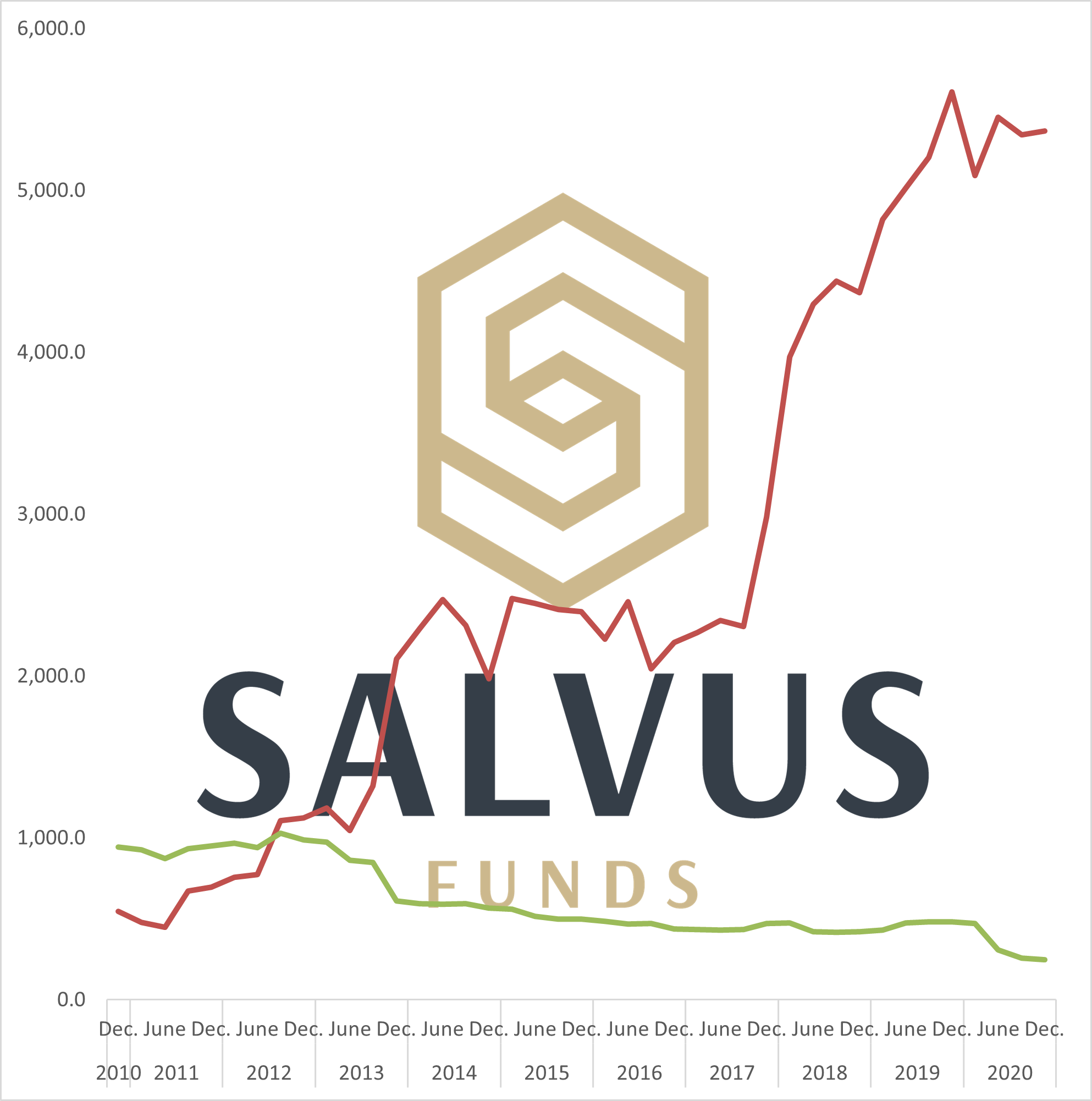

The type of investment funds is split into Open End and Closed End.

As shown in Figure 3, the consistent theme of decreasing Closed End Investment Funds total assets/liabilities continued at a steady pace and a new all-time low was recorded at 249.0 million EUR (green line in Fig. 3), while the increase in Open End (red line in Fig.3) was 23.9 million EUR bringing the total for the category at 5,367.8 EUR million.

Figure 3 – The progress of the total assets/liabilities in EUR million (bars), outstanding at end of period broken down by type of investment fund.

5. The Investment funds total assets/liabilities, UCITS/Non-UCITS breakdown table

The final table of the Investment Funds Statistics as reported by CBC shows total assets/liabilities for both, UCITS and Non-UCITS investment funds. As reported in our previous commentary on the investment funds in Cyprus, at the end of March 2020, total assets/liabilities for UCITS amounted to 321.6 EUR million outstanding while for Non-UCITS, the total assets/liabilities were reported at 5,242.3 EUR million outstanding. At the end of June 2020, these had increased to 366.2 million EUR and 5,394.4 million EUR for UCITS and Non-UCITS respectively. In the previous period to this one, (data up to the end of September 2020), had reported UCITS and Non-UCITS at 365.4 million EUR and 5,237.3 million EUR respectively. The current report which includes data up to the end of the year 2020, has UCITS and Non-UCITS at 411.4 million EUR and 5,205.5 million EUR respectively.

Conclusion

One quarter at a time, the work done by all stakeholders to cement Cyprus as an investment funds jurisdiction is proving itself. After the very strong 2019 and the conclusion of a mixed 2020 in terms of total assets, the continuously increasing number of reporting entities is a testament to the tenacity of the Investment Funds industry in Cyprus. Among the main drivers, one is the Register Alternative Investment Fund (RAIF) as the investment fund type of choice.

The continued complications and impacts arising from the Covid-19 pandemic, a crisis that has interrupted economic activity like no other event is forcing disruptive developments across many different business verticals. There has been recovery in the financial markets, and while there are still many unknowns, this quarter’s data and the work of CySEC and CIFA, the Funds service providers and SALVUS, are obvious pillars for the growing AUM in this jurisdiction. In 2020, the 6th Cyprus Funds Summit saw the presence of entities of the magnitude and credibility of MUFG, Aviva, Calastone and Bloomberg which is, as we enter 2021, is both a responsibility and an opportunity to work harder towards a more complete Investment Funds ecosystem in Cyprus.

As always, we welcome creative thinking and an optimistic attitude in facing this crisis as an opportunity. Part of our public #StayAhead commitment is exactly about that. We remain committed to contributing further and aiding in this recovery and our clients and partners growth.

Do not hesitate to contact us if you require further information. We will be glad to support you in finding an appropriate solution or answering your questions.

#StayAhead.

Should you be interested to read about relevant topics on the funds sector, feel free to visit our earlier articles:

- The different types of Alternative Investment Funds

- Questions on Registered Alternative Investment Funds (RAIF) in Cyprus

- AIFMs, UCITs and the Liquidity stress Tests (LST)

- Is it all gloom and doom for hedge funds returns (YTD)?

- The Reasons AIFM, AIF and RAIF come to Cyprus

- The Cypriot AIF: legal forms, types and requirements

- The Cypriot RAIF: substance, requirements and tax

- Cyprus Investment Funds Statistics – November, 2020

- Cyprus Investment Funds Statistics – August, 2020

- Cyprus Investment Funds Statistics – May, 2020

- Cyprus Investment Funds Statistics – February, 2020

The information provided in this article is for general information purposes only. You should always seek professional advice suitable to your needs.