Key Updates from Global Regulatory Frameworks 2020

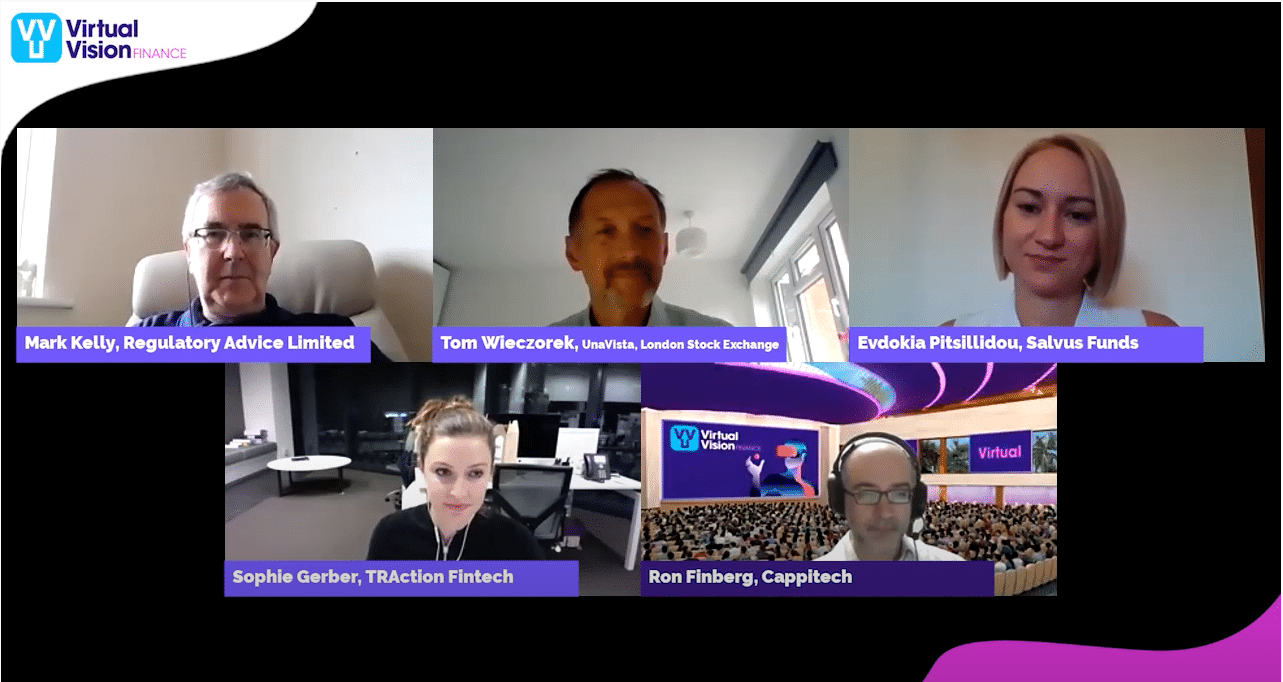

On Wednesday the 10th of June 2020, the iFX EXPO and Virtual Vision Finance brought to us the first-ever visual expo for the online trading industry. Evdokia Pitsillidou, the SALVUS Funds Director of Risk & Compliance, was invited to discuss in a panel titled “Key Updates from Global Regulatory Frameworks” for this year’s challenges and tomorrow’s regulatory trends from CySEC, FCA, and ASIC.

With this release, we summarize the key points answered by Evdokia during the discussion. Feel free to watch the entire regulatory discussion from the panel.

What’s new from CySEC this year?

Halfway through 2020, CySEC has issued a number of updates, new circulars, and directives. CySEC is proactively encouraging firms to ensure compliance with the regulation. The main objective of the Cypriot regulator is to ensure the establishment of high standards for investor protection and the application of best practices by ALL obliged entities.

Even during the last month, we have seen CySEC enforcing fines to Investment Firms, suspension of licenses, imposing personal fines, and prohibiting individuals from exercising professional activity in the regulated investment services space. These decisions were a result of inspections and complaints by investors, with CySEC emphasizing on subjects such as

- MiFID II and the application of leverage restrictions,

- Ensure compliance with Best Execution obligations, and

- On Anti-Money Laundering.

- CySEC supporting its efforts to combat AML, since February, introduced the AML Examinations for ALL appointed AML Compliance Officers. Due to COVID, the twelve (12) month-timeframe during which appointed AML Compliance Officers need to pass their AML examinations is extended according to the respective period of postponement.

- We at SALVUS, provide support and preparation seminars to all candidates preparing for the AML examination. We further invested and offer our courses through the online platform of the Institute for Professional Excellence.

On another note, during the period of the COVID-19 lockdown, we have seen CySEC supporting ALL obliged entities towards meeting their reporting obligations by providing a reasonable extension to most of the Annual obligations. This stance has been appreciated by many across the industry, as firms’ main concern during this difficult period was to ensure the safety of all employees and the firms’ continuous operations.

We are now heading towards the end of this challenging period and firms are called to work towards meeting the extended annual obligations. As the obligations are many, SALVUS specialists have authored frequent articles and updates to support our clients and associates in meeting their annual reporting obligations.

Following CySEC’s best execution review from last year, have they contacted firms about problems, and have there been any enforcements?

CySEC imposed an administrative fine for 160,000 EUR to a firm not Complying with the Best Execution obligations as per the famous article 28 of the 2017 Law. Additionally, administrative sanctions are imposed at a personal level to 2 Executive Directors following the withdrawal of the Firm’s license in 2018. The personal fines include an administrative fine of 350,000 EUR and 10 years of prohibition of exercising professional activities.

The said firms, among other regulatory obligations, were not executing orders favorable to the client and they were not meeting the best execution responsibilities. Following CySEC’s thematic review on best execution and the issuance of the Circular 343, we have been called to support firms in performing a gap analysis on their process and procedures, and help them improve their practices.

We have further seen CySEC issuing thematic reviews on EMIR and MiFIR, with the primary aim to urge firms to review their current practices and comply with the regulation.

In preparation for Brexit, is there a demand for UK firms to either purchase existing CySEC license or apply for a new license?

We are aware of a number of UK firms received their CySEC license, some others are in the process of getting their CySEC license activated, and of others are looking to acquire an existing CySEC license. Our understanding is that CySEC is well backed up and is currently conducting interviews with key stakeholders via online methods (skype, zoom, etc) in order not to delay the activation process. Yet, due to COVID while CySEC coped with many challenges, many firms faced their own internal issues in completing the authorization procedure and they requested extensions from CySEC.

Overall, we haven’t observed any delay from CySEC issuing new licenses. It is worth noting that during the whole year of 2019, CySEC authorized 8 new investment firms, and until today in 2020, we already have 4 licenses authorized and a few more in the waiting.

What are the main topics with high demand and inquiries from Investment Firms?

One of our main projects, and the majority of requests these days, are on the AML Examinations. The examinations resumed early in June and there is a high demand for preparation towards the AML examination. We have invested and prepared the most complete online AML exam preparation course in partnership with the Institute for Professional Excellence, and we host workshops every month to support candidates studying towards the examination.

SALVUS continues to support all investment firms in meeting all the regulatory obligations extended due to COVID 19.

The information provided in this article is for general information purposes only. You should always seek professional advice suitable to your needs.