Cyprus, Setting up an Electronic Money Institution (EMI)

Continuing the series of articles dedicated to exploring the range of business models via regulated entities set up in Cyprus, here we discuss details on the establishment of an Electronic Money Institution (EMI).

In this commentary, the team at SALVUS, goes through the following;

– what is an Electronic Money Institution,

– the advantages of setting up an Electronic Money Institution in Cyprus,

– the activities and services of an Electronic Money Institution, and

– how we can support you.

What is an Electronic Money Institution (EMI)?

An Electronic Money Institution (EMI) acts as the digital alternative to a bank with deposits stored in an ‘electronic wallet’ using a device or a card. An EMI operates through an electronic online platform and its license allows the issuance of debit cards. By extension, payment transactions can be carried out by the clients of the EMI, either by using the platform or the issued debit card.

Electronic money in Cyprus can be issued by;

- Banks,

- Banks licensed by the designated authorities of other member states,

- Cooperative credit institutions,

- Institutions providing postal payment services and which issue electronic money by virtue of relevant legislation,

- The European Central Bank and the national central banks, when not acting in their capacity as monetary or other public authorities,

- Member states or their regional or local authorities, when acting in their capacity as public authorities, and

- Electronic money institutions.

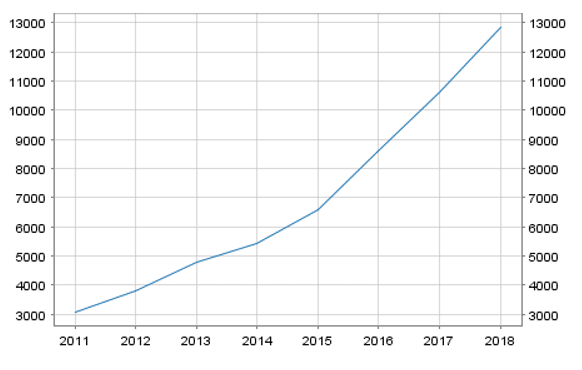

The total electronic money reported by EMIs in the euro area at the end of 2018 amounted to nearly 13 billion EUR. This is 4 times the total reported at the beginning of 2011.

Source: European Central Bank – Statistical Data Warehouse

Why Cyprus?

- Cyprus is ranking high in terms of its tax regime attractiveness and is considered a favourable jurisdiction for holding and investment services companies. A snapshot is summarised in the bullets below:

- The net profits from EMI’s activities are subject to a corporation tax of 12.5%, one of the lowest corporate tax rates in Europe.

- Gains from the sale of titles, and, in most cases, dividends received are exempt from tax.

- No withholding tax for non-residents on dividend, interest and royalties paid.

- The Republic of Cyprus has a wide network of double tax treaties agreements.

- Cyprus is a gateway to Europe offering to the Institutions a ‘single passport’ to provide its services across the EU.

- Reliable professional support services are provided with high standards including legal, compliance, accounting and banking.

A European Passport

Electronic Money Institutions (EMIs) in the EU are regulated by the EU Directive 2009/110/EC. The Cypriot Electronic Money Institutions (EMIs) are regulated by the Central Bank of Cyprus (CBC) under the Electronic Money Law 81(I) of 2012, which was enacted by the abovementioned EU directive.

The Cyprus Electronic Money Institutions, once established and duly licensed, are allowed to offer its services in all EU member states on a cross-border basis without any further authorization, or by setting up branches.

Activities and services of an EMI

Electronic Money Institutions (EMIs) can be engaged to offer the following activities;

- Maintain a readily available electronic device, in which monetary value may be stored, for the purpose of placing electronic money in circulation,

- Maintain a readily available instrument for the distribution of electronic money for the purpose of placing electronic money in circulation,

- Receive monetary value in exchange for the distribution of electronic money,

- Distribute electronic money,

- Place electronic money in circulation,

- Sell or resell electronic money products,

- Renew the value of an electronic money product already in the hands of an electronic money holder,

- When not acting in their capacity as payers to distribute electronic money to a person holding or purporting to hold electronic money,

- Redeem electronic money held by a holder of electronic money,

- Acting in the capacity of an employee or other capacity on behalf of a third party, approach persons who are holders or potential holders of electronic money.

Electronic Money Institutions (EMIs) can be engaged to offer the following services;

- Provision of payment services,

- Operation of payment services,

- Granting of credit facilities related to payment services,

- Engage in Commercial activity or business.

How SALVUS can support you?

Our team through the licensing service, will support you with the efficient and effective implementation of all steps required for the establishment of a company authorized to act as an Electronic Money Institution. Further, we provide consulting services to the Senior Management to ensure compliance within the regulatory framework post-authorisation and remain available to guide them in performing their responsibilities adequately and in a timely manner.

We remain at your disposal should you have any question on EMIs and the all of the above. Please contact us via info@salvusfunds.com.

If you are interested to know more, you can read our previous articles with information related to setting up a Cyprus Investment Firm (CIF), the available investment and ancillary services under a CySEC license and MiFID II instruments along with the different type of CIFs and application fees for granting a CySEC license.

The information provided in this article is for general information purposes only. You should always seek professional advice suitable to your needs.