Cyprus Investment Funds Statistics – December 2021

On the 18th of February 2022, the Statistics Department of the Central Bank of Cyprus (CBC) released the 4th quarter’s statistics update for Investment Funds based in Cyprus for 2021. As the reporting frequency is quarterly, the current dataset period includes data until the 31st of December.

This particular set of data reveals a significant all-time high, recorded in both assets under management (AUM) by investment funds in Cyprus and the number of investment funds regulated by CySEC.

The statistics are presented in the following 5 tables:

- Investment funds balance sheet data: assets,

- Investment funds balance sheet data: liabilities,

- Investment funds total assets/liabilities, by nature of investment,

- Investment funds total assets/liabilities, by type of investment fund,

- Investment funds total assets/liabilities, UCITS/Non-UCITS breakdown.

1. The Investment funds balance sheet data: assets table

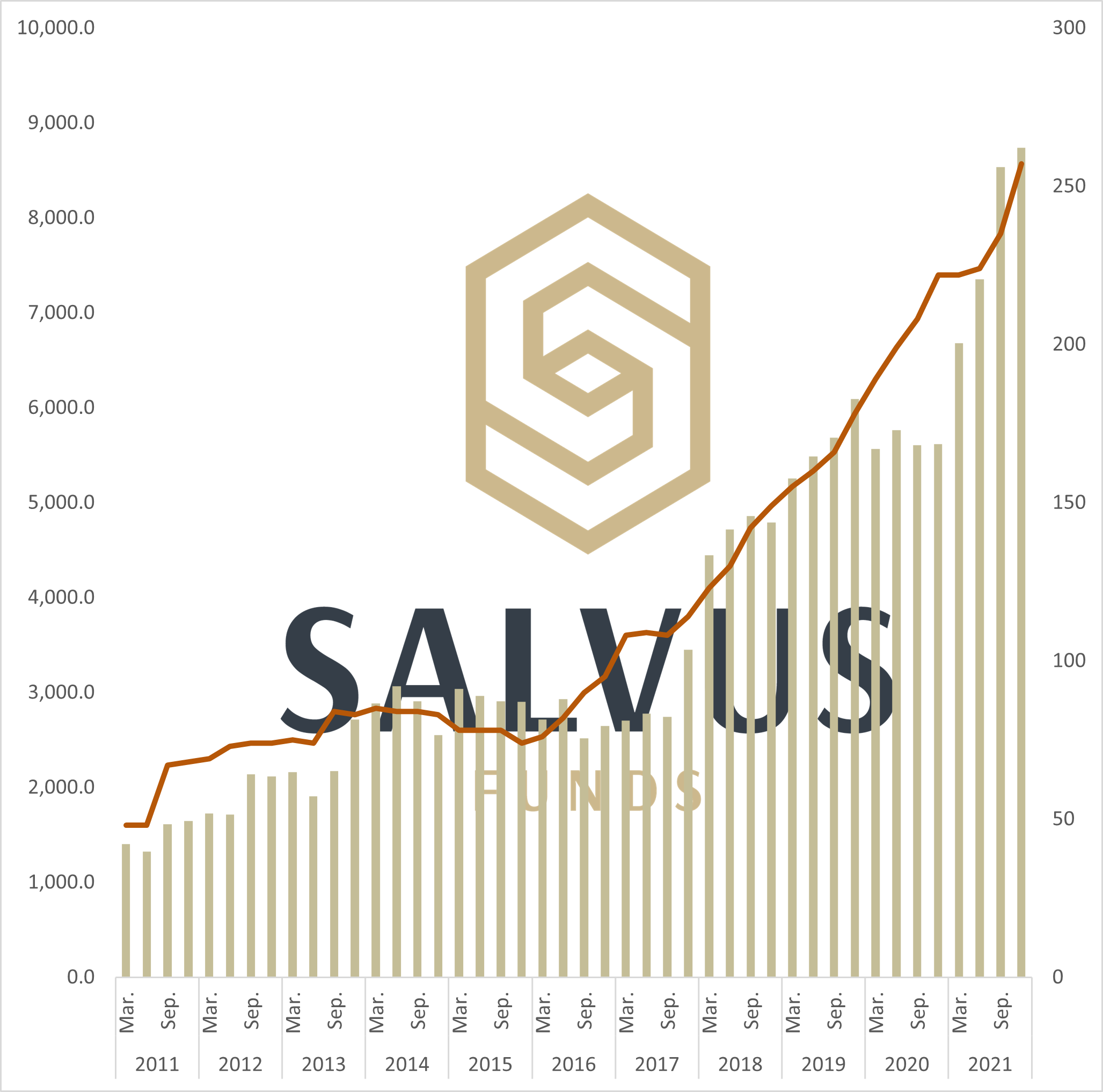

The total assets outstanding at the end of December 2021, were reported at 8,740.4 million EUR. This represents a 2.4% increase on 8,535.6 million EUR total assets reported at the end of September 2021. This is the fourth consecutive all-time high recorded, which the Investment Funds team at SALVUS considers extremely insightful as to the state of the Cypriot jurisdiction. The graph in Figure 1 below is telling of how much and how far the industry has grown and continues to do so.

The number of reporting entities increased to 257 from 235 previously reported which represents the largest increase in reporting entities in a single quarter since the CBC began releasing such reports. It is important to note that in the last 18 quarter-over-quarter reports there have been 17 increases in the number of investment funds reporting to CySEC and 1 quarter with no change.

Figure 1 below, combines these 2 data sets with

- the y-axis on the left and the bars along the x-axis showing the Total Assets in EUR million, outstanding,

- the y-axis on the right and the line along the x-axis showing the Number of Reporting Entities, at the end of each period.

Figure 1 – The progress of Total Assets in EUR million (bars), outstanding at end of the period and the Number of Reporting Entities (line) from the end of March 2011 until the end of December 2021.

2. The Investment funds balance sheet data: liabilities table

The breakdown of the liabilities on the balance sheet of Investment Funds in Cyprus is reported in 3 categories by the CBC:

- Loans

- IF (Investment Funds) shares/units

- Other liabilities (incl. financial derivatives)

IF shares/units are consistently the majority of liabilities on the balance sheet of investment funds. At 7,685.7 million EUR outstanding at the end of December 2021, IF shares/units amount to 87.9% of the total liabilities of Investment Funds in Cyprus. This figure represents a quarter-over-quarter increase of 0.35%. Next, loans recorded a decrease in outstanding amounts for the first time since September 2020 falling by 4.1% (34.3 million EUR). Finally, other liabilities (incl. financial derivatives) also recorded a decrease for the first time since September 2020, falling to 248.8 million EUR outstanding which results in a 9% decrease from September 2021.

3. The Investment funds total assets/liabilities, by nature of investment table

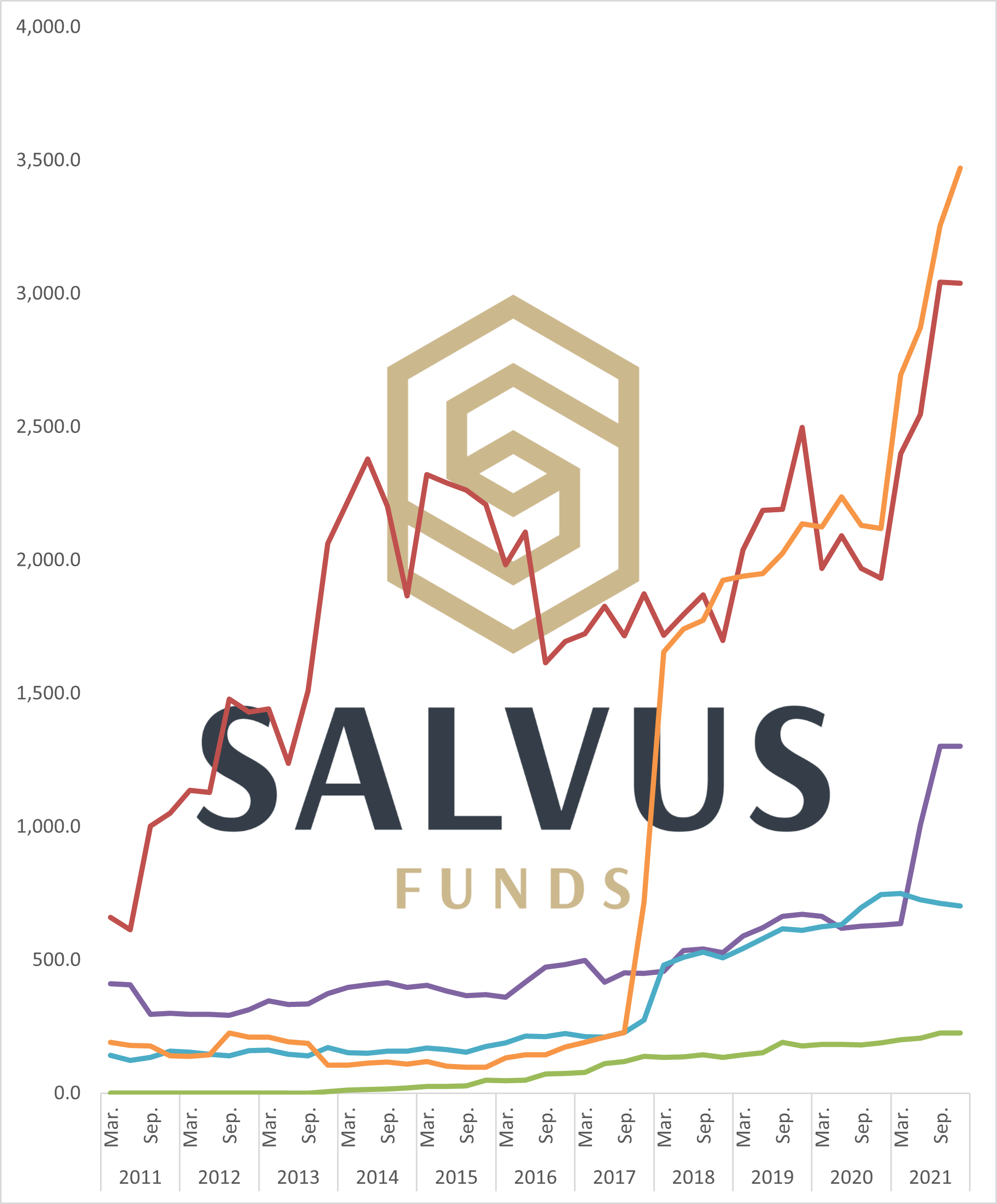

The breakdown by nature of investment of the assets/liabilities on the balance sheet of Investment Funds in Cyprus is collected in 5 categories (Figure 2) by the CBC:

- Equity

- Bond

- Mixed

- Real Estate

- Other

All categories, except Real Estate and Equity, recorded an increase compared to the end of September 2021. This has maintained Other (orange line in Fig.2) as the biggest category ahead of the Equity (red line in Fig.2) category. The handover from Equity to Other as the majority category has been a consistent theme through 2020 until the end of this reporting period. Mixed (purple line in Fig.2) for the third consecutive quarter has continued to hold the 3rd spot over Real Estate (blue line in Fig.2) which is still the 4th category. Bonds (green line in Fig.2), reported an increase, and continue their rising trend as the 5th category.

It is noteworthy that the total outstanding, for Other (orange line in Fig.2) asset class, was recorded at 3,471.2 million EUR. This is a 6.67% increase from the previously reported quarter in September 2021, making fastest-growing category (percentage-wise) for the 4th quarter in 2021.

Figure 2 – The progress of total assets/liabilities in EUR million (bars), outstanding at end of period broken down by nature of investment.

4. The Investment funds total assets/liabilities, by type of investment fund table

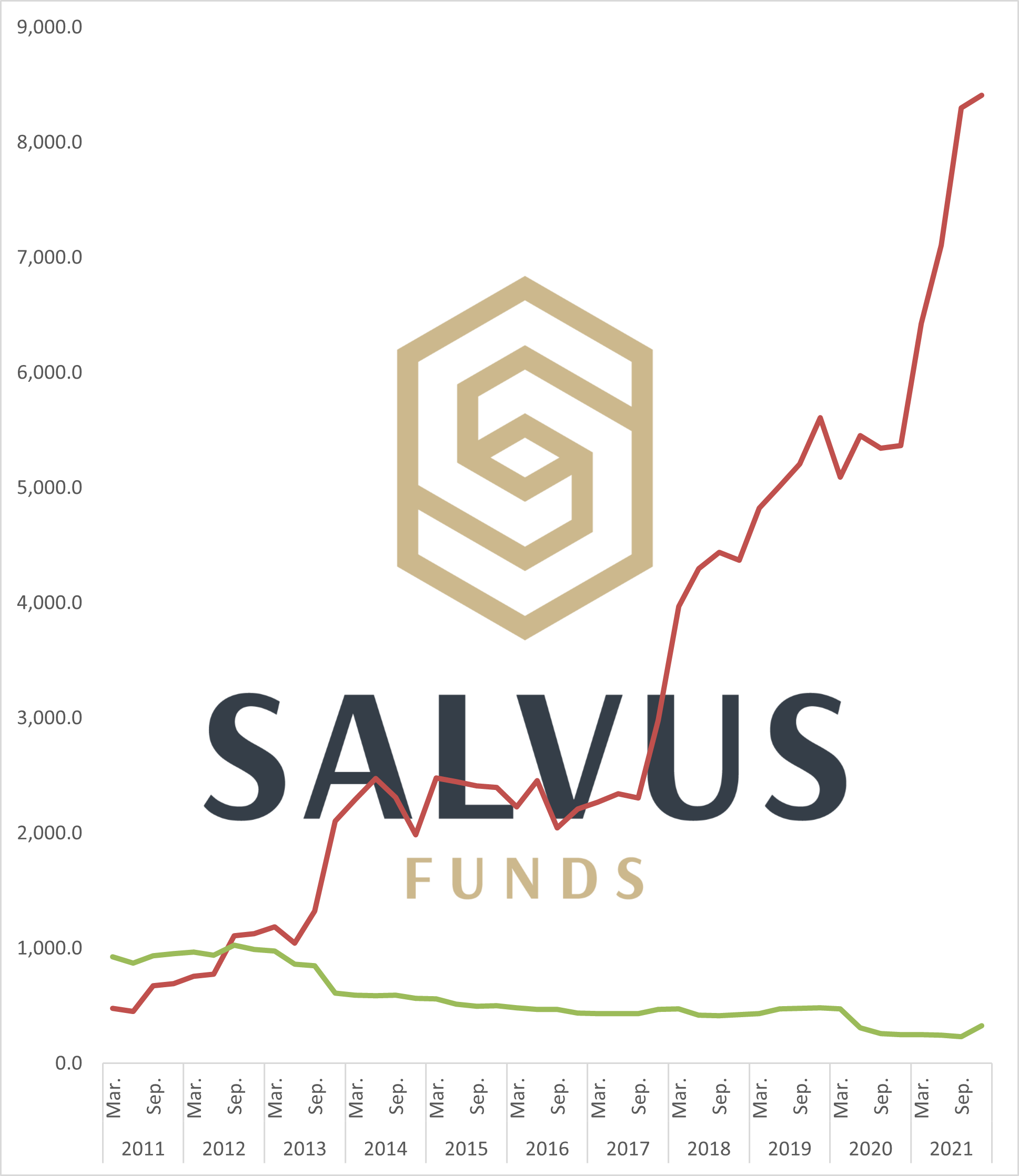

As shown in Figure 3, Close End investment funds grew for the first time in a year. The growth amounted to 40% (from 234.7 million EUR in September 2021 to 329.6 million EUR by the end of December 2021; green line in Fig.3). Open End investment funds continued their growth trend and reached a new all-time high of 8,410.8 million EUR.

Figure 3 – The progress of the total assets/liabilities in EUR million (bars), outstanding at end of period broken down by type of investment fund.

5. The Investment funds total assets/liabilities, UCITS/Non-UCITS breakdown table

The final table of the Investment Funds Statistics as reported by CBC shows total assets/liabilities for UCITS and Non-UCITS investment funds. The current report, with data up to the end of December 2021, has UCITS and Non-UCITS at 479.9 million EUR and 8,260.5 million EUR respectively. The consistent gap between UCITS and Non-UCITS investment funds under CySEC continues to show.

Conclusion

Once again, the Central Bank of Cyprus’ Q4 report for 2021 has been intriguing. This latest, 4th in a row, all-time high of 8.7 billion EUR AUM attests to the jurisdiction’s credentials to continue growing. This growth is in turn expected to support the ecosystem led by the work of the national competent authority, CySEC, and the professional association of CIFA.

We as SALVUS welcome these positive numbers, and once more use them as motivation to work harder and better towards a more complete Investment Funds ecosystem in Cyprus.

Do not hesitate to contact us if you require further information. We will be glad to support you in finding an appropriate solution or answering your questions.

#StayAhead.

Should you be interested to read about relevant topics on the funds sector, feel free to visit our earlier articles:

- AIFMs, UCITs and the Liquidity stress Tests (LST)

- Is it all gloom and doom for hedge funds returns (YTD)?

- The Reasons AIFM, AIF and RAIF come to Cyprus

- The Cypriot AIF: legal forms, types and requirements

- The Cypriot RAIF: substance, requirements and tax

- Cyprus Investment Funds Statistics – September, 2021

- Cyprus Investment Funds Statistics – June, 2021

- Cyprus Investment Funds Statistics – March, 2021

- Cyprus Investment Funds Statistics – December, 2020

- Cyprus Investment Funds Statistics – November, 2020

- Cyprus Investment Funds Statistics – August, 2020

- Cyprus Investment Funds Statistics – May, 2020

- Cyprus Investment Funds Statistics – February, 2020

The information provided in this article is for general information purposes only. You should always seek professional advice suitable to your needs.