Cyprus Investment Funds Statistics – June 2022

On the 17th of August 2022, the Statistics Department at the Central Bank of Cyprus (CBC) released the latest statistics update concerning the state of the investment funds industry in Cyprus. The CBC’s investment funds statistics report covers Q2 2022.

The Investment Funds team at SALVUS regularly publishes summary articles, demonstrating the Cypriot investment funds statistics in a digestible manner. Along the way, our team highlights the key trends within the sector.

At a glance, the total assets of the investment funds industry in Cyprus bounced back in Q2 climbing to the second-highest assets under management (AUM) figure. This turnaround comes after the investment funds in Cyprus recorded a decrease for the first time in nearly two years at the end of Q1 as reported by the CBC.

Throughout this article, our Investment Funds team present the statistics in more depth through the sections below:

1. Investment funds balance sheet data: assets,

2. Investment funds balance sheet data: liabilities,

3. Investment funds total assets/liabilities, by nature of investment,

4. Investment funds total assets/liabilities, by type of investment fund,

5. Investment funds total assets/liabilities, UCITS/Non-UCITS breakdown.

1. The investment funds balance sheet data: assets table

At the end of June 2022, the total assets outstanding for the investment funds industry in Cyprus were reported at 8,704 million EUR by the CBC. This represents a 0.14% increase on the 8,692 million EUR total assets reported at the end of March 2022. Even though the increase may seem insignificant, the investment funds industry in Cyprus continues to show its resilience following a decrease in total assets at the end of Q1 from the previous quarter.

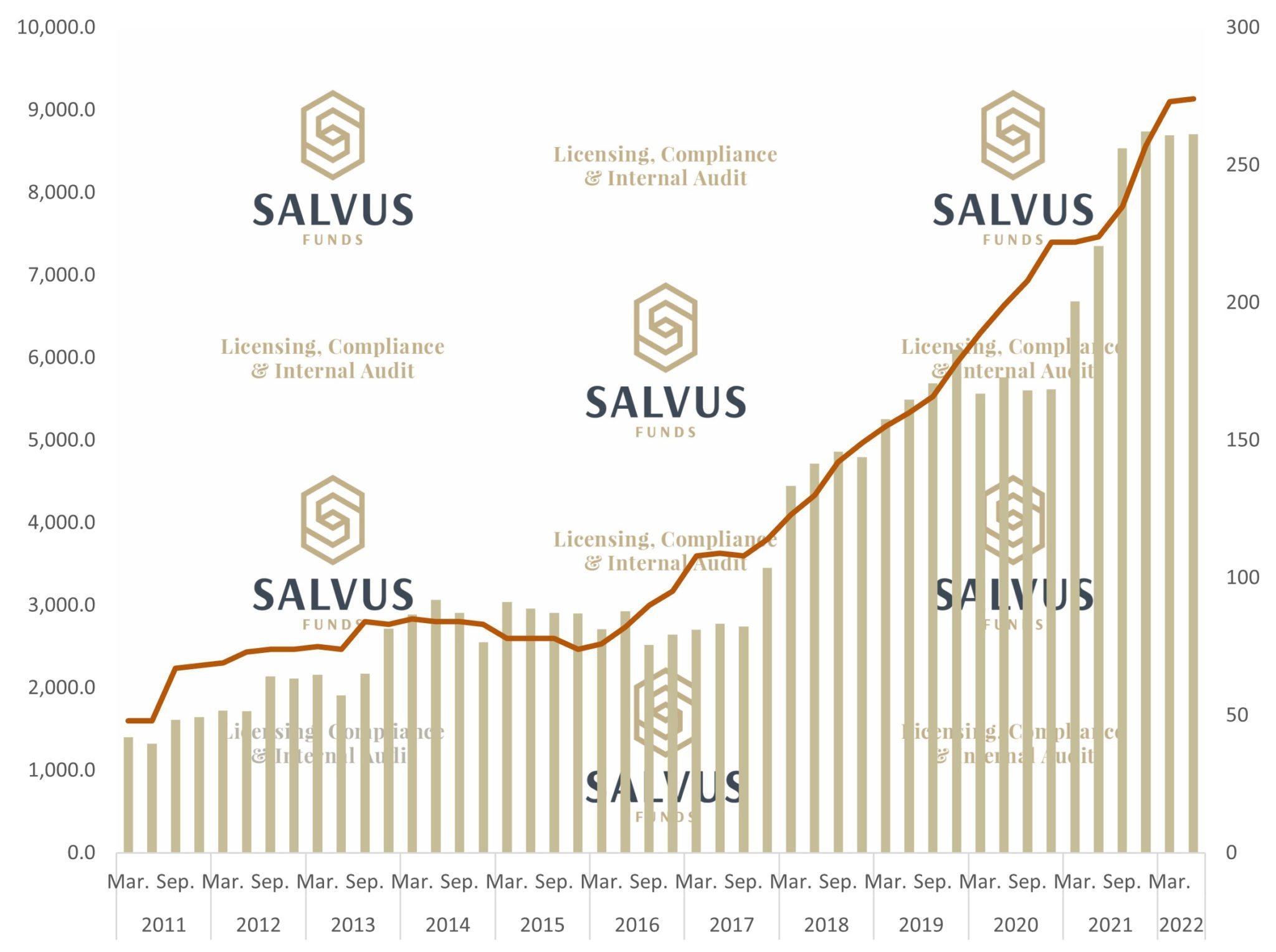

Figure 1 below visualises the Cypriot investment funds’ resilience over the more recent years despite a global pandemic and the war in Ukraine. Given this, the CBC’s Q2 investment funds reported figure is the second-highest AUM ever in Cyprus.

Similarly, the number of reporting entities grew by 1 quarter-over-quarter, rising to an all-time high of 274.

Figure 1 below, combines the 2 aforementioned data sets with

- the y-axis on the left and the gold bars along the x-axis showing the Total Assets in EUR million, outstanding,

- the y-axis on the right and the red line along the x-axis showing the Number of Reporting Entities, at the end of each period.

Figure 1 – The progress of Total Assets in EUR million (bars), outstanding at end of the period and the Number of Reporting Entities (line) from the end of March 2011 until the end of June 2022.

2. The investment funds balance sheet data: liabilities table

In the next section the CBC uses 3 segments to categorise the liabilities on the balance sheet of the investment funds in Cyprus:

- Loans

- IF (Investment Funds) shares/units

- Other liabilities (incl. financial derivatives)

IF shares/units continue to dominate the vast majority of liabilities on the balance sheet of the investment funds, amassing to 89.88%; a 1.21% increase quarter-over-quarter. Elsewhere Loans continued their decline quarter-over-quarter, coming down to 616.7 million EUR: a 2.6% decrease from Q1. The most noticeable change once again comes through Other liabilities (incl. financial derivatives), where the segment recorded a 24.04% decrease quarter-over-quarter, bringing the total value down to 264.2 million EUR from 324 million EUR previously recorded in Q1.

3. The investment funds total assets/liabilities, by nature of investment table

The third section of the Investment Funds Statistics report by the CBC for Cyprus in Q2 of 2022 depicts the breakdown by nature of investment of the total assets/liabilities. In particular, the CBC demonstrates the figures through the following categories:

- Equity

- Bond

- Mixed

- Real Estate

- Other

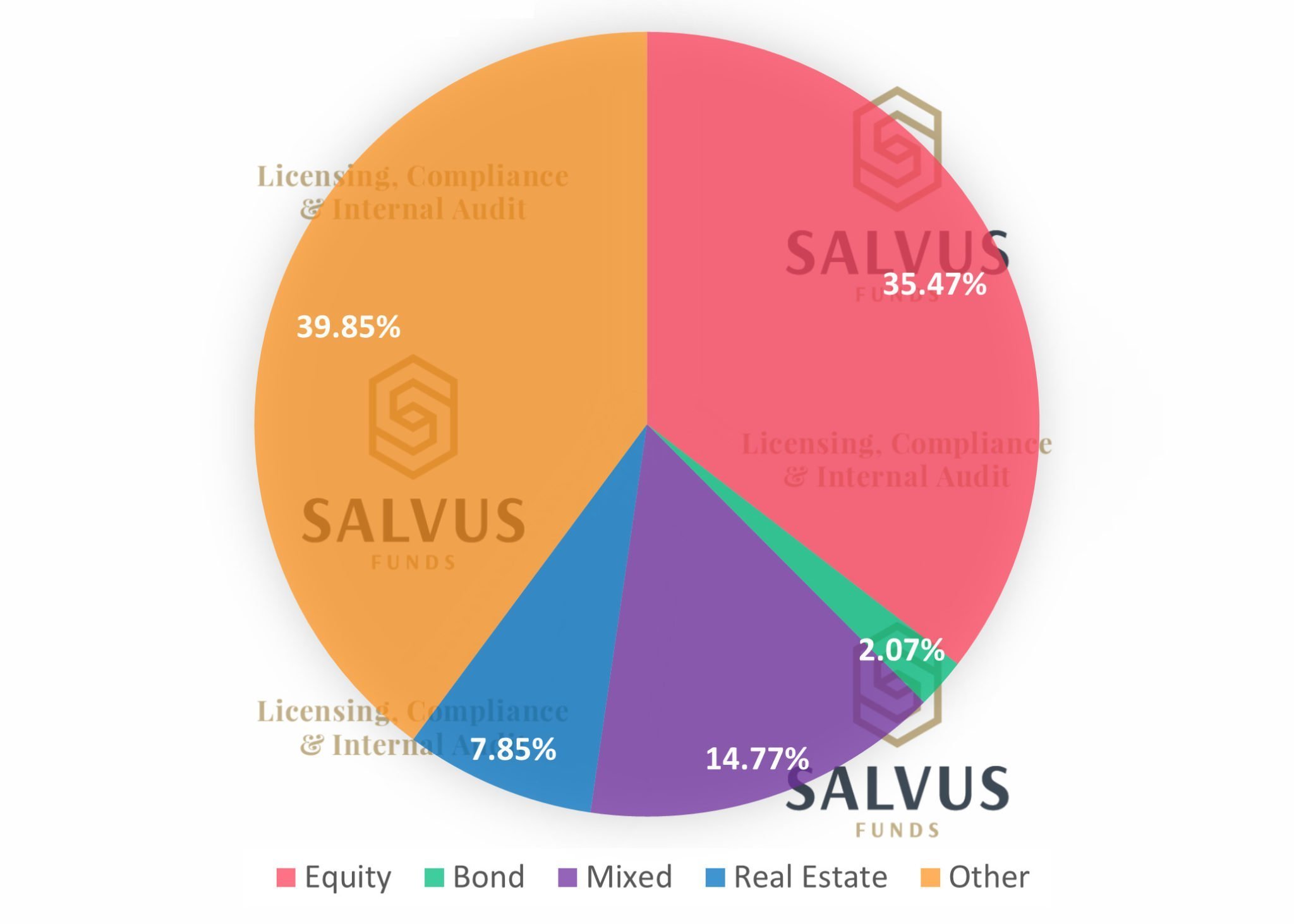

During the latest report, the Other category was the only category to record an increase quarter-over-quarter. Furthermore, the Other category (orange in Fig. 2), continues to maintain its spot as the largest category after growing to 3,468.1 million EUR (a 3.49% increase from Q1 2022). The Equity category (red in Fig. 2) maintains its position behind Other as the second largest category followed by Mixed (purple in Fig. 2), Real Estate (blue in Fig. 2), and Bond (green in Fig. 2), respectively.

It is important to highlight that Bond had the largest percentage decline in total assets/liabilities by nature of investment which equated to a 13.38% drop from the previous quarter.

Figure 2 – The split between the investment funds’ total assets/liabilities by nature of investment as outlined by the Central Bank of Cyprus within the Q2 2022 Investment Funds Statistics report.

4. The investment funds total assets/liabilities, by type of investment fund table

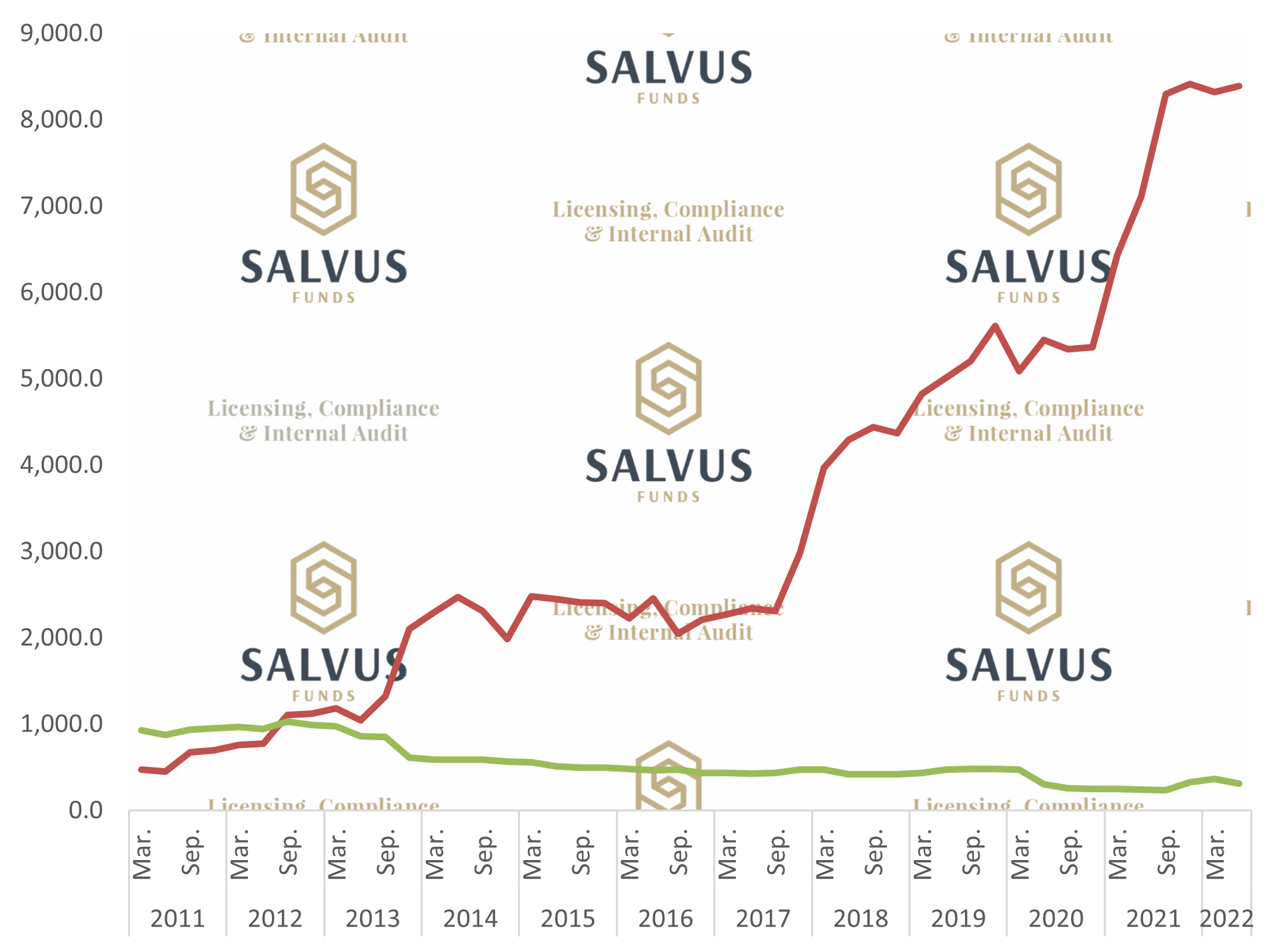

The CBC splits between Open End and Closed End fund types.

According to Figure 3, Close End (green line) Investment Funds decreased after having two consecutive quarters of growth (in Q1 2022 & Q4 2021). In contrast, Open End (red line) increased to 8,388.6% million EUR from Q1.

Figure 3 – The progress of the total assets/liabilities in EUR million (bars), outstanding at end of period broken down by type of investment fund.

5. The investment funds total assets/liabilities, UCITS/Non-UCITS breakdown table

The final section the CBC reported on shows the total assets/liabilities for UCITS and Non-UCITS investment funds. For Q2, the consistent gap between the two categories continues. UCITS saw a 7.87% decrease from the previous quarter whereas Non-UCISTS experienced a 0.6% increase during the same period. Non-UCITS now stand at 8,269.4 million EUR, a new all-time high for this category. In contrast, UCITS are reported at 434.6 million EUR.

Conclusion

As SALVUS, we are intrigued by the CBC’s Cypriot Investment Funds Statistics report for Q2 2022. Given the adversity of the current economy and the uncertainty that lies ahead, the investment funds industry in Cyprus has managed to bounce back after a decreased AUM in Q1 from the previous quarter. Although a small figure, the investment funds AUM in Cyprus grew to 8,704 million EUR (0.14%) quarter-over-quarter.

In this regard, the hard work of CySEC (investment services regulator in Cyprus), the professional association of CIFA, and the CBC has been paying off.

Furthermore, we look forward to positively impacting the investment funds industry by assisting investment funds to obtain authorisations, comply with regulations, and create additional value for the financial ecosystem in Cyprus and around the globe.

Please contact us if you require help setting up your investment fund in Cyprus or would like additional information about the investment services ecosystem.

#StayAhead

Should you be interested to read about relevant topics on the funds sector, feel free to visit our earlier articles:

- AIFMs, UCITs and the Liquidity stress Tests (LST)

- Is it all gloom and doom for hedge funds returns (YTD)?

- The Reasons AIFM, AIF and RAIF come to Cyprus

- The Cypriot AIF: legal forms, types and requirements

- The Cypriot RAIF: substance, requirements and tax

- Cyprus Investment Funds Statistics – March, 2022

- Cyprus Investment Funds Statistics – December, 2021

- Cyprus Investment Funds Statistics – September, 2021

- Cyprus Investment Funds Statistics – June, 2021

- Cyprus Investment Funds Statistics – March, 2021

- Cyprus Investment Funds Statistics – December, 2020

- Cyprus Investment Funds Statistics – November, 2020

- Cyprus Investment Funds Statistics – August, 2020

- Cyprus Investment Funds Statistics – May, 2020

- Cyprus Investment Funds Statistics – February, 2020

The information provided in this article is for general information purposes only. You should always seek professional advice suitable to your needs.