Establishing a CySEC Investment Firm in Cyprus in 2023

According to the most recent statistics published by the European Securities and Markets Authority (ESMA), Cyprus has emerged as the primary destination for companies offering investment services within the European Union (EU) and European Economic Area (EEA). With a substantial clientele of over 2.5 million cross-border retail investors, Cyprus has firmly established itself as an international hub for investment services.

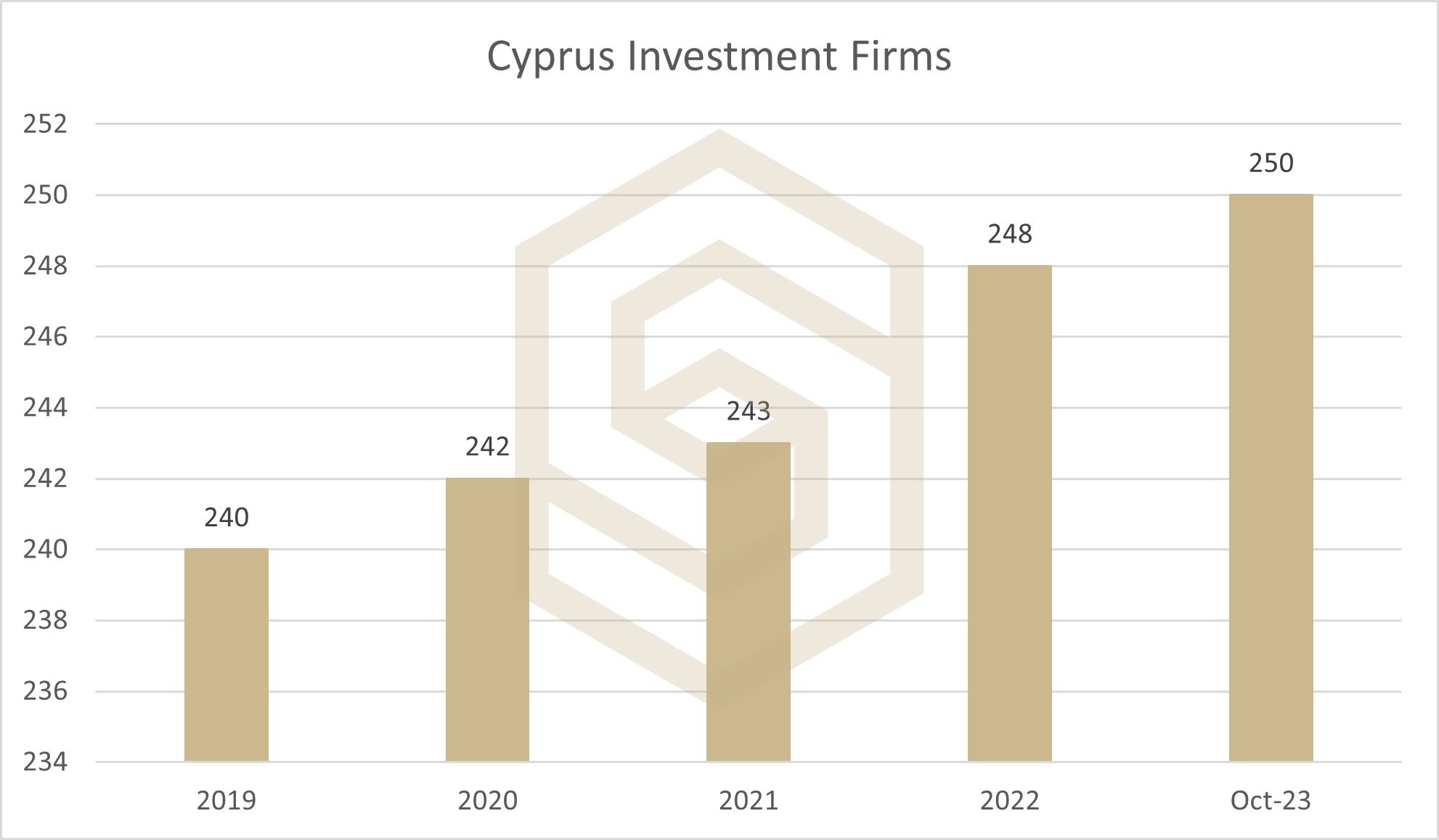

As per the Chairman of the Cyprus Securities and Exchange Commission (CySEC), Cyprus stands ready to welcome highly qualitative business. As illustrated in the diagram provided by CySEC, there are currently 250 Cyprus Investment Firms (CIF) with diverse business models. These entities are actively engaged with the provision of investment services to a wide range of clients, including retail and professional investors, as well as eligible counterparties.

Source: Cyprus Securities and Exchange Commission Press Release dd. 23/10/2023

In this article, the SALVUS Investment Firms Licensing team presents the key advantages of establishing an Investment Firm in Cyprus. The team offers valuable insights into investment and ancillary services, along with the corresponding capital requirements. Furthermore, the team addresses various licensing challenges and explains how SALVUS can facilitate the entire process. The article focuses on the following core areas:

1. Why establish a Cyprus Investment Firm (CIF) under CySEC?

2. Investment & Ancillary Services and Capital Requirements

3. Key licensing challenges

4. How SALVUS can support your CIF licensing

We regularly share bite-sized insights on LinkedIn such as those found in this article

1. Why establish a Cyprus Investment Firm under CySEC?

One of the primary factors driving the growth of the investment services sector in Cyprus is its unique combination of memberships. Cyprus holds memberships in the European Union, the Eurozone, the Council of Europe, the United Nations, the World Bank, the World Trade Organization, the International Monetary Fund, and the British Commonwealth. Along with this, its status as a signatory to numerous international conventions and its strategic location bridging three continents position Cyprus as a global business hub.

With the support of Cyprus’s contemporary legal framework and its extensive affiliations, a CIF may benefit from the EU passporting system to extend its services across the EEA. This eliminates the necessity for additional licenses and provides CIF with the flexibility to set up EU branches and utilise tied agents across the EEA.

The attractive tax regime, one of the lowest among EU member states, makes Cyprus an appealing choice for establishing a company. With more than 60 double tax treaties in place, it provides further incentives for businesses. From a cost perspective, setting up an investment firm in Cyprus is generally cost-efficient, considering factors like administration, operating expenses, and the cost of living.

Moreover, the legal framework also allows for the outsourcing of various services, offering flexibility in terms of the number and skill set of required employees. The emerging sectors of payment and crypto services have contributed to the development of a diverse and well-educated workforce.

2. Investment and Ancillary Services & Capital Requirements

Cyprus Investment Firms can operate through varying business models, using a combination of investment and ancillary services, offered for different financial instruments. Each model shall be strategically designed to align with the business plan and objectives established during the licensing phase. The following table outlines the range of investment and ancillary services that a firm can potentially offer as a Cyprus Investment Firm.

| Type of service | Included services |

|---|---|

| Investment Services | 1. Reception and transmission of orders relating to one or more financial instruments 2. Execution of orders on behalf of clients 3. Dealing on own account 4. Portfolio management 5. Investment Advice 6. Underwriting of financial instruments and/or placing of financial instruments on a firm commitment basis 7. Placing of financial instruments without a firm commitment basis 8. Operation of a Multilateral Trading Facility (MTF) 9. Operation of an Organised Trading Facility (OTF) |

| Ancillary Services | 1. Safekeeping and administration of financial instruments for the account of clients, including custodianship and related services such as cash/collateral management and excluding maintaining securities accounts at the top tier level 2. Granting credits or loans to an investor to allow them to carry out a transaction in one or more financial instruments, where the firm granting the credit or loan is involved in the transaction 3. Advice to undertakings on capital structure, industrial strategy and related matters and advice and services relating to mergers and the purchase of undertakings 4. Foreign exchange services where these are connected to the provision of investment services 5. Investment research and financial analysis or other forms of general recommendation relating to transactions in financial instruments 6. Services related to underwriting 7. Investment services and activities as well as ancillary services of the type included under Section A or B of Annex 1 related to the underlying of derivatives included under points (5), (6), (7) and (10) of Section C of the MiFID II Directive where these are connected to the provision of investment or ancillary services |

In adherence to the European Investment Firms Regulation and Directive (IFR/IFD), CIF entities shall maintain specific capital levels based on the investment and ancillary services they provide. During the licensing process, potential CIF are required to satisfy the regulator of their ability to maintain the prescribed permanent minimum capital requirements, as illustrated in the table below.

| Investment Services | Capital Requirements |

|---|---|

| Any of the below: 1. Reception and transmission of orders concerning one or more financial instruments, 2. Execution of orders on behalf of clients, 4. Portfolio management, 5. Investment advice, 7. Placing of financial instruments without a firm commitment basis. Without holding client funds. | €75,000 |

| Any of the below: 1. Reception and transmission of orders concerning one or more financial instruments, 2. Execution of orders on behalf of clients, 4. Portfolio management, 5. Investment advice, 7. Placing of financial instruments without a firm commitment basis. With holding client funds. | €150,000 |

| Any of the below: 3. Dealing on own Account 6. Underwriting of financial instruments and/or placing financial instruments on a firm commitment basis. Plus any of the below: 1. Reception and transmission of orders concerning one or more financial instruments, 2. Execution of orders on behalf of clients, 4. Portfolio management, 5. Investment advice, 7. Placing of financial instruments without a firm commitment basis. With holding client funds | €750,000 |

Once the CIF receives its license and commences operations, capital requirements are recalibrated, factoring for the firm’s fixed overheads and the associated risks stemming from the services rendered.

3. Key licensing challenges

The foundation of a successful licensing application with CySEC hinges on the establishment and communication of a clear, comprehensive, and well-supported business plan. The business plan should address pivotal aspects of the application process, including the selection of services offered, targeted markets, and client demographics. Each choice is important to be articulated with explicit reasoning.

Furthermore, the firm must elaborate on its strategies to meet organisational and operational prerequisites, in addition to instituting necessary governance structures. Therefore, it is paramount that individuals on the firm’s Board of Directors, Senior Management, and other key function holders are not only of good repute but also possess the requisite knowledge and expertise.

An equally significant facet of the application involves the firm’s ability to meet the mandated capital requirements. In this context, the regulator must be assured of the legitimacy and sustainability of the applicant’s financial resources.

It is essential to recognise that the process of CIF licensing is inherently dynamic. Its success depends greatly on the applicant’s readiness to respond to regulatory inquiries promptly, providing the information and documentation needed.

4. How SALVUS can support your CIF licensing

The SALVUS Investment Firms Licensing team leverages its unique and extensive experience in the licensing of Cyprus Investment Firms across diverse business models and objectives. Our sophisticated project management approach is tailored to enable the selection of investment and ancillary services that precisely align with your business vision and requirements.

We serve as a dependable intermediary between the regulatory authority and your applying firm, streamlining the entire licensing process by facilitating the collection and submission of all necessary information and documentation. Furthermore, our expertise extends to assisting you in assembling a highly effective team and optimising the allocation of your financial resources between human and technological assets.

Upon the successful acquisition of your CIF license, our Regulatory Compliance team stands ready to guide you through the activation of the license and ensure the fulfilment of all post-licensing regulatory obligations.

Contact us at info@salvusfunds.com if you are interested in establishing a Cyprus Investment Firm; our Investment Firms Licensing team is ready to answer your questions.

#StayAhead

The information provided in this article is for general information purposes only. You should always seek professional advice suitable to your needs.