The Roadmap to Sustainable Finance: ESG, EU Regulations, and Impact

The transition to a more sustainable and environmentally friendly financial system has become one of the principal objectives of the European Union (EU). In this endeavour, the European Securities and Markets Authority (ESMA) plays a pivotal role by striving to ensure that the European financial markets actively support and facilitate this shift. This involves the integration of environmental, social, and governance (ESG) factors into the markets’ core activities.

Yet, the increasing demand for ESG investments presents significant challenges. Regulatory authorities must carefully navigate the rapidly evolving regulatory landscape to prevent inconsistent application across markets. Essential to this effort is the establishment of sufficient transparency and comparability regarding the actual sustainability impact of financial products offered, and the sustainability profiles of institutions. These aspects underpin the EU Regulations formulated around sustainable finance.

Throughout this article, the SALVUS Regulatory Compliance team explores the term Sustainable Finance while examining the origins of the European Green Deal. Moreover, the team identifies regulatory obligations stemming from the Capital Requirements Regulation (CRR), the Investment Firms Regulation (IFR), and Markets in Crypto Assets (MiCA) Regulation. The article focuses on the following critical areas:

1. The objectives of Sustainable Finance

2. The European Green Deal

3. CRR & IFR Prudential Disclosures

4. Considerations for Crypto-Asset Service Providers

We regularly share bite-sized insights on LinkedIn such as those found in this article

1. The objectives of Sustainable Finance

Sustainable finance is the process of taking environmental, social and governance considerations into account when making investment decisions in the financial sector. In alignment with the European Union’s mandates, the objectives of sustainable finance are threefold:

- financing and supporting economic growth, and at the same time easing pressures on the environment.

- advancing the climate and environmental goals outlined in the European Green Deal, combating in this way climate change and environmental degradation.

- enhancing transparency and mitigating ESG-related risks impacting the financial system, with the implementation of appropriate governance on financial and corporate aspects.

In this context, ESG factors scrutinize critical areas that can have either direct or indirect implications on the financial performance of an ecosystem due to non-financial performance metrics.

2. The EU Green Deal

At the European Union level, the European Green Deal outlines the EU’s sustainable economic growth strategy, following its endorsement of the United Nations’ 2030 Agenda and the Paris Agreement. The EU Green Deal was formally adopted in December 2019, with a firm commitment from the European Commission to achieve climate neutrality by the year 2050.

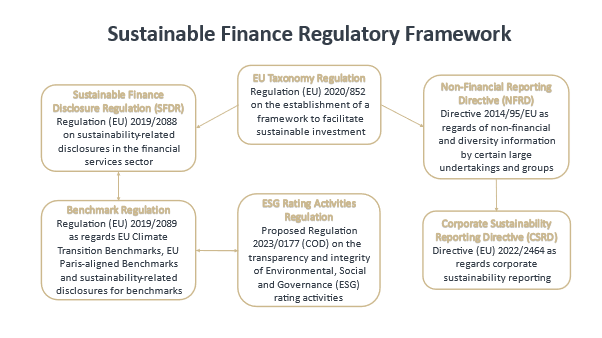

The primary aim of the European Green Deal is to reshape the EU into a modern resource-efficient, and globally competitive economy. This has led the European legislative bodies to develop a targeted set of regulations, designed to advance the core goals of the European Green Deal. The diagram below illustrates the primary EU regulations that are directly relevant to the scope of sustainable finance.

Several economic activities are expected to be on a transition path to becoming sustainable within specific timeframes. This transformation also encompasses the provision of investment and financial products and services. In alignment with this objective, the European Directives governing Markets in Financial Instruments (MiFID), Alternative Investment Fund Managers (AIFMD), and Undertakings for Collective Investment in Transferable Securities (UCITS) have been enhanced.

3. CRR & IFR Prudential Disclosures

Financial institutions will have an obligation under the Capital Requirements Regulation and Investment Firms Regulation to provide specific disclosures pertaining to ESG risks associated with their operations.

As per the CRR, large institutions that have issued securities trading on any regulated market of any EU Member State must disclose information regarding ESG risks, including physical and transition risks. Similarly, under the IFR, investment firms categorised as class 2 within the prudential supervision framework, are required to make similar disclosures on ESG risks.

Both large institutions and class 2 investment firms are required to provide such information during the initial year of operation under these requirements and biannually after that. To facilitate this, the European Banking Authority (EBA) has developed a set of Implementing Technical Standards (ITS) that demand the disclosure of quantitative information from large institutions. However, it is worth noting that the EBA has not yet published the corresponding ITS regarding the ESG disclosures required by investment firms.

4. Considerations for Crypto-Asset Service Providers

With the implementation phase of the MiCA Regulation beginning in June 2023, regulated entities are now required to consider climate and other environmental-related adverse impacts of the products and services offered. Thus, EBA and ESMA are entrusted to develop the necessary regulatory technical standards on the content, methodologies and presentation of the information of such impacts relevant to crypto assets.

Final thoughts

Similar to other new fields of financial markets legislation, sustainable finance requires going through a learning curve in order to ensure that the basics of the sustainability transition are well understood. Nonetheless, sustainable finance imposes a distinctive challenge as it requires investors, institutions, and regulatory authorities to possess a solid understanding of the intersection between sustainability matters and finance.

In this regard, professionals working in Cyprus Investment Firms and Funds, Payment Institutions and other entities regulated by the Cyprus Securities and Exchange Commission (CySEC) and the Central Bank of Cyprus (CBC) are encouraged to develop a profound understanding of sustainable finance and ESG factors. To facilitate this endeavour, SALVUS Funds, in collaboration with the Institute for Professional Excellence (IforPE), has created a self-study course titled Sustainable Finance: Regulatory Framework & ESG Factors.

This comprehensive course functions as a roadmap for professionals within the financial sector, introducing them to the concepts of sustainable finance and providing them with a comprehensive overview of the European regulatory framework. The course delves into ESG factors, shedding light on their implications for financial institutions and the associated regulatory obligations. Additionally, professionals who undertake this course will gain exposure to a diverse range of investment strategies designed to prioritize ESG objectives.

The Regulatory Compliance team at SALVUS is entrusted with the mission of supporting investment and financial institutions in their pursuit of regulatory compliance. The team stands ready to assist in the development and enhancement of policies and procedures, facilitating a seamless transition into a more sustainable economy while ensuring the continuity of business operations. Furthermore, SALVUS is equipped to aid regulated entities in fulfilling their regulatory reporting obligations, promoting successful and timely compliance.

Contact us at info@salvusfunds.com if you require support with your regulatory requirements and reporting obligations or if you have any questions about our Sustainable Finance: Regulatory Framework & ESG Factors course with IforPE.

#StayAhead

Should you be interested to read more about Sustainable Finance, MiCA Regulation or the Prudential Requirements of European Investment Firms, please visit the selected articles below:

- MiCA Regulation: Embarking on a new era for Crypto-Assets & CASP

- ESG Regulations for European regulated entities

- Investment Firms New Capital Requirements (IFR & IFD)

The information provided in this article is for general information purposes only. You should always seek professional advice suitable to your needs.