Cyprus Investment Funds Statistics – June 2023

On the 17th of August 2023, the Statistics Department at the Central Bank of Cyprus (CBC) released the latest statistics update concerning the investment funds industry in Cyprus. The CBC’s investment funds statistics report covers the second quarter (Q2) of 2023.

The SALVUS Investment Fund team regularly publishes an article such as this one to demonstrate the Cypriot investment funds statistics for the previous quarter in a digestible manner. Throughout the summary, our team highlights the key trends within the sector.

Throughout this article, our Investment Funds team present the statistics in more depth through the sections below:

1. Investment Funds balance sheet data: assets,

2. Investment Funds balance sheet: liabilities,

3. Investment Funds total assets/liabilities, by nature of investment,

4. Investment Funds total assets/liabilities, by type of investment fund,

5. Investment Funds total assets/liabilities, UCITS/Non-UCITS breakdown.

We regularly share bite-sized insights on LinkedIn such as those found in this article

1. The investment funds balance sheet data: assets table

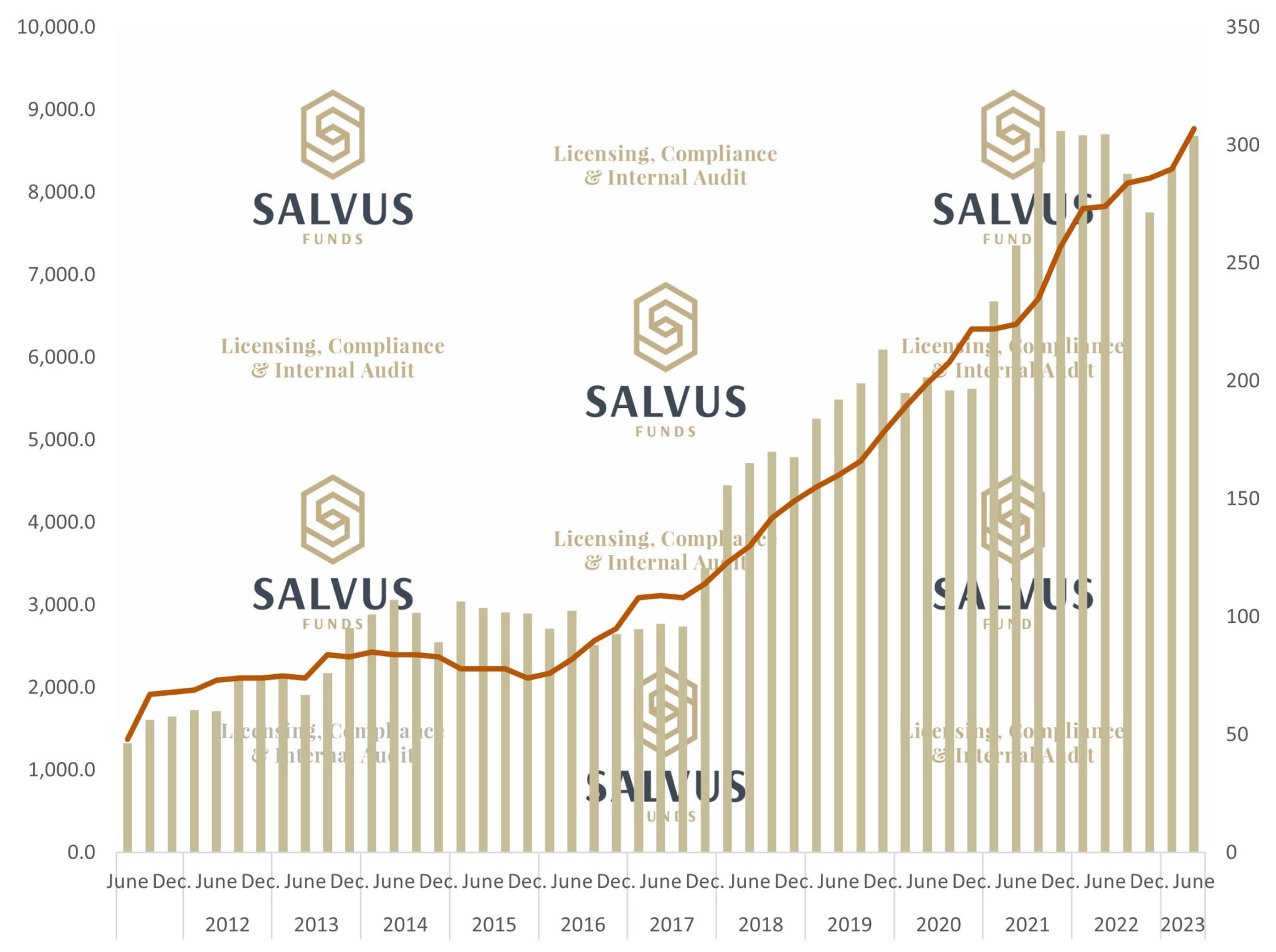

At the end of June 2023, the CBC reported the total assets outstanding for the investment funds industry in Cyprus at 8,685.7 million EUR. This represents a 4.6% increase from the 8,303.4 million EUR total assets reported at the end of March 2023. The latest report represents consecutive quarterly growth for the first time in nearly 2 years. Additionally, the number of reporting entities continued to grow quarter-over-quarter, reaching an all-time high of 307 – 17 more reporting entities than the previous quarter (the 2nd biggest quarter-over-quarter increase ever).

Figure 1 below, combines the 2 aforementioned data sets with

- the y-axis on the left and the gold bars along the x-axis showing the Total Assets in EUR million, outstanding,

- the y-axis on the right and the red line along the x-axis showing the Number of Reporting Entities, at the end of each period

Figure 1 – The progress of Total Assets in EUR million (bars), outstanding at the end of the period and the Number of Reporting Entities (line) from the end of March 2011 until the end of June 2023.

2. The investment funds balance sheet data: liabilities table

In the next section, the CBC uses 3 segments to categorise the liabilities on the balance sheet of the investment funds in Cyprus:

- Loans

- IF (Investment Funds) shares/units

- Other liabilities (incl. financial derivatives)

IF shares/units have continuously dominated the liabilities of Cypriot investment funds and it is no different this time around either. IF shares/units contribute to 96.22% of the total liabilities (a 5.18% increase from the previous quarter). Loans managed to stabilise from their sharp decrease recorded 2 quarters ago and reported an 8.48% increase quarter-over-quarter, sitting at 162.1 million EUR. Other liabilities (incl. financial derivatives) recorded a 20.27% decrease and now only represent 1.92% of the total liabilities.

3. The investment funds total assets/liabilities, by nature of investment table

The third section of the Investment Funds Statistics report by the CBC for Cyprus in Q2 of 2023 depicts the breakdown by nature of investment of the total assets/liabilities. In particular, the CBC demonstrates the figures through the following categories:

- Equity

- Bond

- Mixed

- Real Estate

- Other

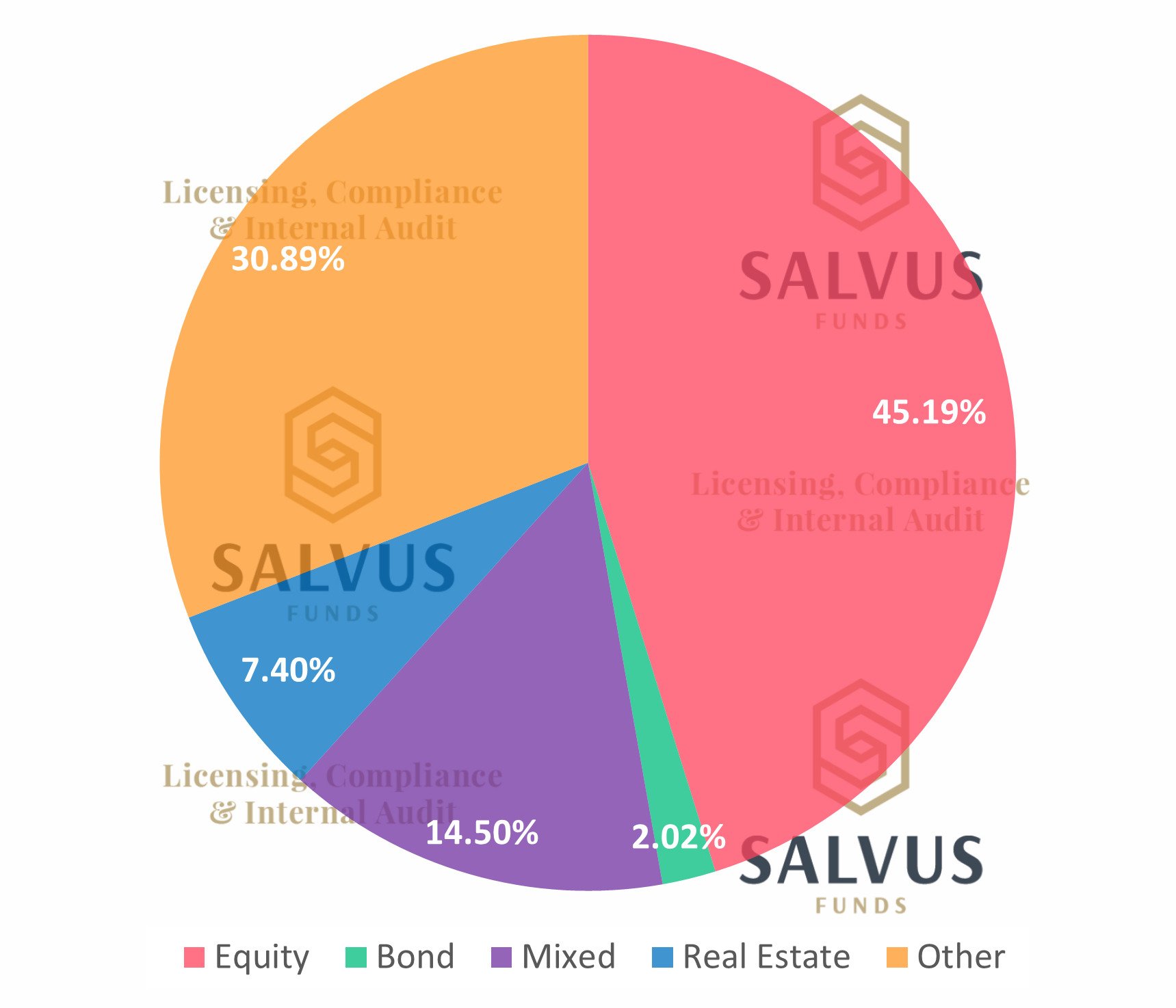

The Equity (red in Fig. 2) category saw the largest increase (9.87%) quarter-over-quarter. The Other category (Orange in Fig. 2) is firmly the second largest category of total assets/liabilities by nature of investment making up 30.89%. Mixed (purple in Fig. 2), Real Estate (blue in Fig. 2), and Bond (green in Fig. 2), follow respectively.

Figure 2 – The split between the Investment Funds total assets/liabilities by nature of investment as outlined by the Central Bank of Cyprus (CBC) within the Q2 2023 Investment Funds Statistics report.

4. The investment funds total assets/liabilities, by type of investment fund table

The CBC splits between Open End and Closed End fund types.

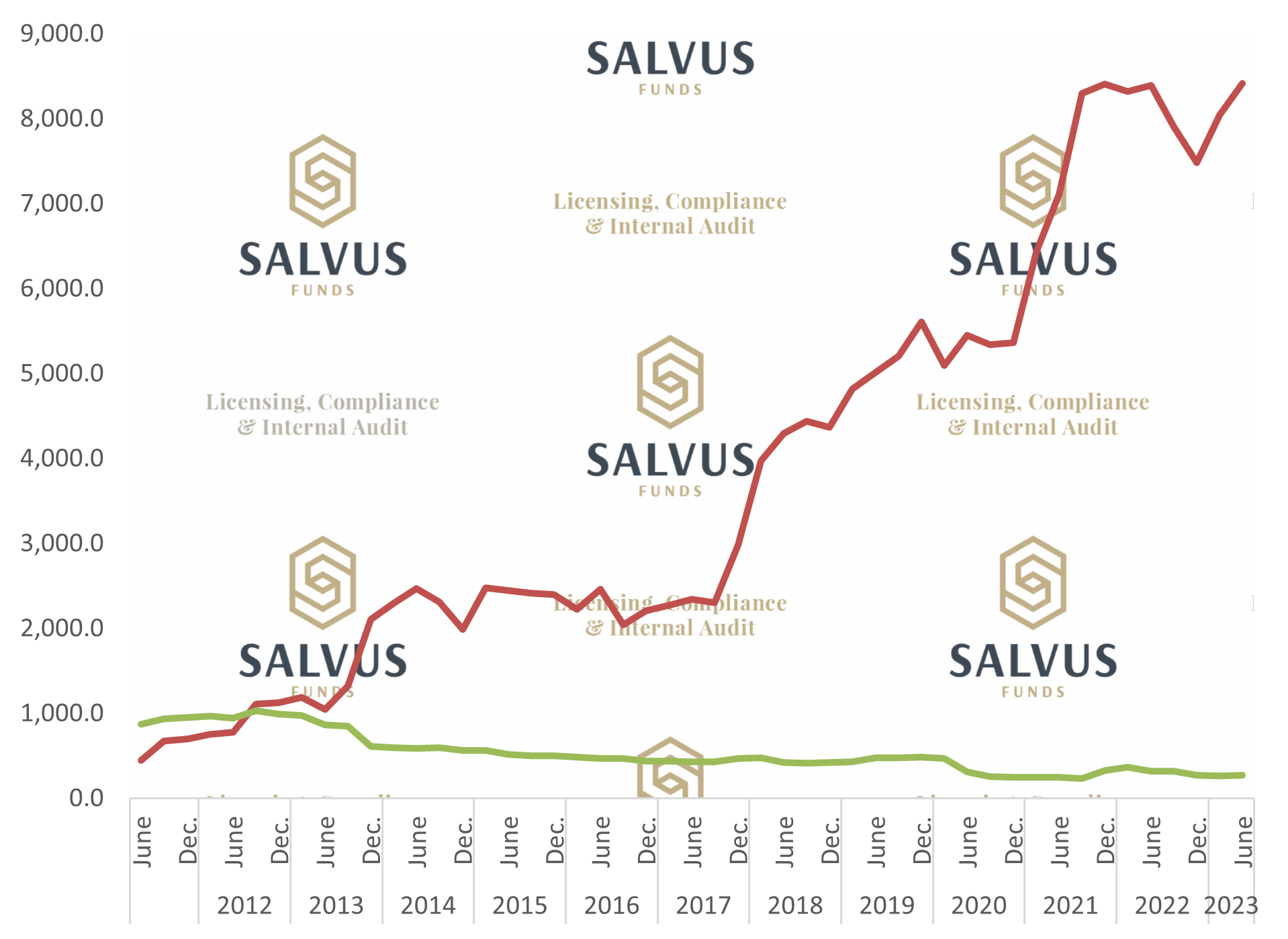

According to Figure 3, Close End (green line) Investment Funds recorded an increase (7.3%) after 2 consecutive decreases and now stands at 270,1 million EUR. The Open End (red line) increased for the 2nd consecutive quarter and now stands at 8,415.7 million EUR (a new all-time high).

Figure 3 – The progress of the total assets/liabilities in EUR million (bars), outstanding at the end of the period broken down by type of investment fund.

5. The investment funds total assets/liabilities, UCITS/Non-UCITS breakdown table

The final section of the CBC reports the total assets/liabilities for UCITS and Non-UCITS investment funds. For Q2 2023, the consistent gap between the two categories continues. UCITS recorded its 3rd consecutive increase, and Non-UCISTS broke into the 8,000 million EUR threshold for the first time in a year, totalling to 8.202.6 million EUR.

Conclusion

As SALVUS, we are impressed with the CBC’s Cypriot Investment Funds Statistics report for Q2 2023. Given the adversity of the current economy and the uncertainty that lies ahead with a possible recession, the investment funds industry in Cyprus continues to attract the establishment of new investment funds whilst proving to be resilient and recording back-to-back AUM increases for the first time in nearly 2 years.

In this regard, the hard work of CySEC (the investment funds regulator in Cyprus) and the work of the dedicated investment fund association (CIFA) in Cyprus, is helping produce tangible results.

Furthermore, we look forward to continue adding value and positively impacting the investment funds industry by assisting investment funds to obtain authorisations and comply with regulations within the financial ecosystem in Cyprus and around the globe.

Contact us at info@salvusfunds.com to learn how we can help set up your investment fund in Cyprus or to learn more about the Cypriot investment services ecosystem.

#StayAhead

Should you be interested to read about relevant topics in the funds sector, feel free to visit our earlier articles:

- AIFMs, UCITs and the Liquidity stress Tests (LST)

- Is it all gloom and doom for hedge funds returns (YTD)?

- The Reasons AIFM, AIF and RAIF come to Cyprus

- The Cypriot AIF: legal forms, types and requirements

- The Cypriot RAIF: substance, requirements and tax

- Cyprus Investment Funds Statistics – March, 2023

- Cyprus Investment Funds Statistics – December, 2022

- Cyprus Investment Funds Statistics – September, 2022

- Cyprus Investment Funds Statistics – June, 2022

- Cyprus Investment Funds Statistics – March, 2022

- Cyprus Investment Funds Statistics – December, 2021

- Cyprus Investment Funds Statistics – September, 2021

- Cyprus Investment Funds Statistics – June, 2021

- Cyprus Investment Funds Statistics – March, 2021

- Cyprus Investment Funds Statistics – December, 2020

- Cyprus Investment Funds Statistics – November, 2020

- Cyprus Investment Funds Statistics – August, 2020

- Cyprus Investment Funds Statistics – May, 2020

- Cyprus Investment Funds Statistics – February, 2020

The information provided in this article is for general information purposes only. You should always seek professional advice suitable to your needs.